Super Effective & Very Simple Forex Trend-Following Trading Strategy – Trend Trading obviously works in Forex market. You have probably heard many phrases such as: “Don’t fight the trend,” “Follow the trend,” “Trend is your friend,” etc. But did the same people told how to do so? In this article, therefore, we will discuss Forex OBOS Zone Trading Strategy and ways how to follow the trend in Forex.

Trend following is not a short term method, therefore, patience, discipline, and determination are necessary.

Trends in financial markets are created by powerful underlying technical and fundamental factors.

Technically, a trend in Forex market is always determined from a larger timeframe by looking at a bigger picture.

Furthermore, we have several tools to help us confirm the underlying trend or warn of a possible trend reversal.

Forex OBOS Zone Trend-FollowingTrading Rules

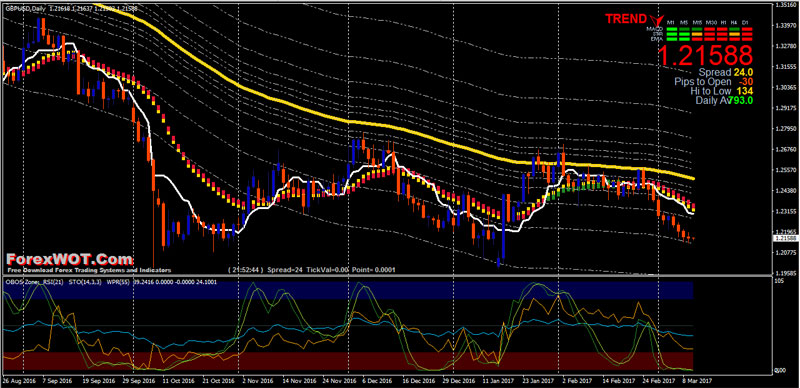

Forex OBOS Zone is a trading system trend-momentum based on EMA, Ichimoku Kijun-Sen, WPR/RSI/Stock and trend indicators as (Fx ultratrend and heiken Ashi smoothed). “Enter with the trend when go the momentum.”

- Recommended Time Frame : 60 min or higher.

- Financial markets : Forex and indicies.

BUY Rules

- Heiken Ashi Smoothed or FX Ultratrend green bar

- Ichimoku Kijun-Sen upward and above Heiken Ashi

- Kijun-Sen and Heiken Ashi above EMA 100 line

- RSI and Stochastic crosses upward above 50 level

SELL Rules

- Heiken Ashi Smoothed or FX Ultratrend red bar

- Ichimoku Kijun-Sen downward and below Heiken Ashi

- Kijun-Sen and Heiken Ashi below EMA 100 line

- RSI and Stochastic crosses downward below 50 level

EXIT Rules

- Exit position with ratio 1.2 stop loss.

- Place initia stop loss on the previous swing.

This is a classic trend-momentum strategy expected profitability 60-70 %.

Be Disciplined

This means that you have to know when to BUY and SELL.

Base your decisions on your pre-planned strategy and stick to it.

Sometimes you will cut out of a position only to find that it turns around and would have been profitable had you held on to it. But this is the basis of a very bad habit.

Don’t ignore your stop losses – you can always get back into a position.

You will find it more reassuring to cut out and accept a small loss than to start wishing that your large loss will be recouped when the market rebounds.

This would more resemble trading your ego than trading the market.