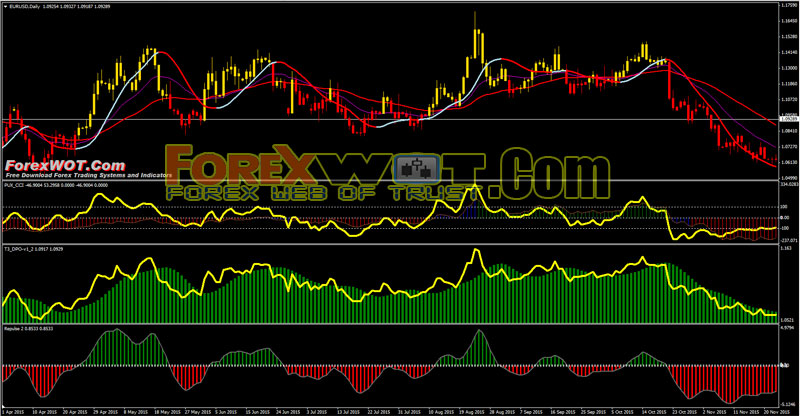

Forex MACD CCI Scalping Trading Strategy is Forex Easy Way to Make Money – MACD CCI Scalping System is a trend momentum strategy based on the MACD and CCI indicator. Best Time Frame : 15 min or 5 min London and US Session, best Currency Pairs : majors: EUR/USD, GBP/USD (low spreads).

The Commodity Channel Index is an extremely useful tool for traders to determine cyclical buying and selling points. Traders can utilize this tool most effectively by (a) calculating an exact time interval and (b) using it in conjunction with several other forms of technical.

Note that the CCI actually looks just like any other oscillator, and it is used in much the same way. Here are the basic rules for interpreting the CCI:

Possible CCI SELL signals:

- The CCI crosses above 100 and has started to curve downwards.

- There is bearish divergence between the CCI and the actual price movement, characterized by downward movement in the CCI while the price of the asset continues to move higher or moves sideways.

Possible CCI BUY signals:

- The CCI crosses below -100 and has started to curve upwards.

- There is a bullish divergence between the CCI and the actual price movement, characterized by upward movement in the CCI while the price of the asset continues to move downward or sidesways.

Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the “signal line”, is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

There are three common methods used to interpret the MACD:

- Crossovers – As shown in the chart above, when the MACD falls below the signal line, it is a bearish signal, which indicates that it may be time to sell.Conversely, when the MACD rises above the signal line, the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum.Many traders wait for a confirmed cross above the signal line before entering into a position to avoid getting getting “faked out” or entering into a position too early, as shown by the first arrow.

- Divergence – When the security price diverges from the MACD. It signals the end of the current trend.

- Dramatic rise – When the MACD rises dramatically – that is, the shorter moving average pulls away from the longer-term moving average – it is a signal that the security is overbought and will soon return to normal levels.

Traders also watch for a move above or below the zero line because this signals the position of the short-term average relative to the long-term average.

When the MACD is above zero, the short-term average is above the long-term average, which signals upward momentum. The opposite is true when the MACD is below zero.

BREAKING DOWN Forex MACD CCI Scalping Trading System. This scalping system is a trend momentum strategy based on the MACD and CCI indicator.

- Pux CCI green Bar.

- RSI Chart bars yellow.

- MA 24 > MA 48.

- Slope Direct Line above MA24 and MA 48.

- T3 DPO yellow line upward and above green bars.

- Repulse MACD green bars and above 100 line.

- Pux CCI red Bar.

- RSI Chart bars red.

- MA 24 < MA 48

- Slope Direct Line below MA24 and MA 48.

- T3 DPO yellow line downward and below green bars.

- Repulse MACD red bars and below -100 line.

Be patient. Once a trade is put on, give it time to work; give it time to insulate itself from random noise; give it time for others to see the merit of what you saw earlier than they.

Be impatient. As always, small loses and quick losses are the best losses. It is not the loss of money that is important. Rather, it is the mental capital that is used up when you sit with a losing trade that is important.

Never, ever under any condition, add to a losing trade, or “average” into a position. If you are buying, then each new buy price must be higher than the previous buy price. If you are selling, then each new selling price must be lower. This rule is to be adhered to without question.

Do more of what is working for you, and less of what’s not. Each day, look at the various positions you are holding, and try to add to the trade that has the most profit while subtracting from that trade that is either unprofitable or is showing the smallest profit. This is the basis of the old adage, “let your profits run.”