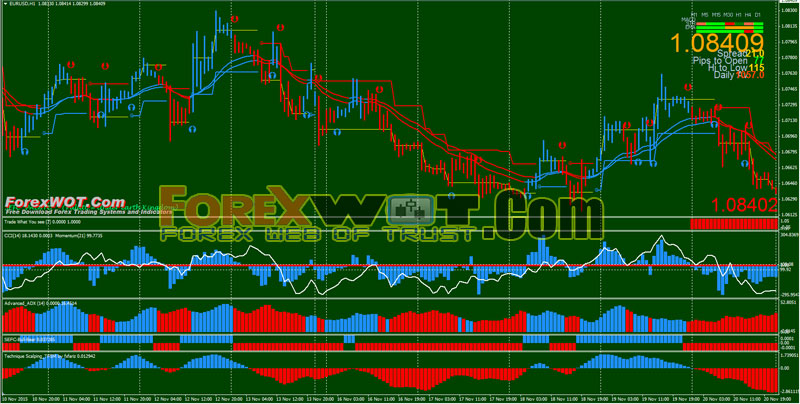

Forex High Profits Trend Following Trading System – This strategy is trend following and to look out to breakouts to take a deal, based on serveral indicators. The most forex indicators are in colour DodgerBlue and Red. That´s the name 😉

What is trend following trading ?… A trading strategy that attempts to capture gains through the analysis of an asset’s momentum in a particular direction. The trend trader enters into a long position when a stock or currency is trending upward (successively higher highs). Conversely, a short position is taken when the stock currency is in a down trend (successively lower highs).

Trend following is an investment strategy based on the technical analysis of market prices, rather than on the fundamental strengths of the companies. In financial markets, traders and investors using a trend following strategy believe that prices tend to move upwards or downwards over time. They try to take advantage of these market trends by observing the current direction and using this to decide whether to buy or sell.

There are a number of different techniques, calculations and time-frames that may be used to determine the general direction of the market to generate a trade signal (stock or forex signals), these including the current market price calculation, moving averages and channel breakouts. Traders who employ this strategy do not aim to forecast or predict specific price levels; they simply jump on the trend and ride it. Due to the different techniques and time frames employed by trend followers to identify trends, trend followers as a group are not always correlated to one another.

This strategy assumes that the present direction of the stock or currency will continue into the future. It can be used by short-, intermediate- or long-term traders. Regardless of their chosen time frame, traders will remain in their position until they believe the trend has reversed – but reversal may occur at different times for each time frame.

How to trade

Simple BUY when a) Indicators alert b) and/or all forex indicators and filters are blue and SELL when all are red. Also pay attention to the usual main trading hours!

Interrupt or no trade when there are differences in indicators colour.

StopLoss

- StopLoss (for my own) under or over the NRTR_Rosh indicators black line.

- Take Profit for your opinion or when the colour of one indicator is changing.

Best Timeframe to me is H4, H1, M30 but it is possible to use it in lower timeframes, but no recommended.