I’ll share with you a super simple and proven profitable price action pattern trading strategy with a high win rate. This strategy is very straightforward but incredibly effective at making the most profit in any market and under any conditions.

So, after you’ve mastered this tutorial, you can leave behind the traditional methods of analyzing price action patterns that may still be confusing for you.

So, without any more delay, let’s go straight to the strategy.

I call this strategy the non-lag price action pattern. As the name suggests, I use a Non-Repaint indicator to help you determine the market trend. This indicator doesn’t repaint, which means that once it determines the trend direction, that decision won’t be reversed.

So, what’s the advantage of using a non-repaint indicator like this?

The benefit is that we can measure the accuracy of each signal generated by the indicator to determine if the signals it will produce in the future are likely to be accurate or not.

If trading signals made in the past by a non-repaint indicator turn out to be highly accurate, then it’s very likely that the trading signals it will generate in the future will also be very accurate. Conversely, if past trading signals from a non-repaint indicator were not accurate, then it’s likely that future trading signals it generates won’t be accurate either.

Therefore, if we have a non-repaint indicator with high accuracy, this can significantly boost your trading success.

- Download “ForexWOT-NonLagMAsystem” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-NonLagMAsystem.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-NonLagMAsystem” trading system and strategy.

- You will see the “ForexWOT-NonLagMAsystem” is available on your Chart.

In this case, we can see that the Non-Lag MA line is around the body of the bullish pin bar.

This is a valid BUY signal. After the bullish pin bar forms perfectly, we place a BUY Stop pending order above the upper tail of the bullish pin bar and set the stop loss below the lower tail of the pin bar.

As you can see, the price quickly rises, as of the time this tutorial is made.

Similar to the bullish trade signal but in the opposite direction. In a bearish trade signal, the first requirement is that the Non-Lag MA line must be red. As you can see in this chart, the Non-Lag MA line is red, indicating a bearish market. Now, you just need to wait for the appearance of a Price Action signal to open a SELL position.

The condition for the Price Action signal is that it should be near the Non-Lag MA line. If the signal is a pin bar, then the Non-Lag MA line should be near the body of the pin bar or around its body.

For example, in this case, we can see that the Non-Lag MA line is around the body of the bearish pin bar.

This is a valid SELL signal. After the bearish pin bar forms perfectly, we place a SELL Stop pending order below the lower tail of the bearish pin bar and set the stop loss above the upper tail of the pin bar.

As you can see, the price quickly drops, providing us with significant profits.

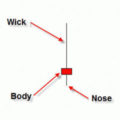

Candlestick and chart patterns are important tools for every price action trader.

Candlestick and chart patterns visually represent these emotions by showing the size of price changes in various shapes and colors. Traders use these patterns to predict the short-term direction of prices.

However, even though there are many candlestick patterns and chart patterns, in my trading strategy, I only concentrate on a few patterns that have the highest chances of winning. So, here are the top 4 Price Action candlestick and chart patterns to trade in this non-lag price action pattern strategy.