How do you know exactly which Pin Bar pattern to trade. in this video we will be going through our very simple yet profitable, “Pin Bar Indicator and Trading strategy”.

A very important point before we start. Everything we discuss in this trading strategy can be used for currency trading, stock trading, and crypto, because price action stays relatively consistent across different assets.

You won’t get as many trades as trading them at Support and Resistance levels – because retracements don’t occur that often – but the trades you do get will have a higher probability of being successful, which still makes it a worthwhile strategy.

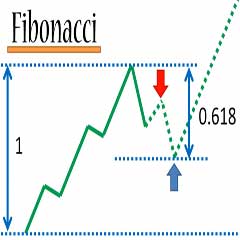

Trading the pin bars is simply a matter of waiting for the price to hit a retracement level and then seeing if a bullish or bearish pin bar forms.

In this example you can see a sharp decline caused the price breakthrough several retracement levels before reversing at the 61.80% level, resulting in a bullish pin bar forming. After the pin appeared the price reversed entirely, rising almost 70 pips in this case. (rising almost 7 times risk taken.)

- Note: Only trade bullish pin bars that form at retracements drawn on upswings and bearish pin that form on retracement drawn on a down-swings.

The following steps will help you identify and trade the Pin Bars At Fibonacci Retracement levels.

- Download “ForexWOT-PinBarDetectorSystem” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-PinBarDetectorSystem.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-PinBarDetectorSystem” trading system and strategy.

- You will see the “Pin-Bar Detector System” is available on your Chart.

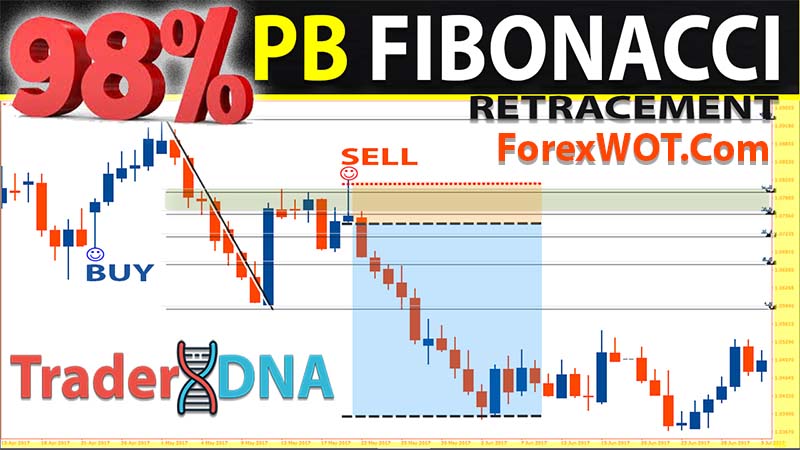

Step 1. Look for a bearish price thrust that clears below the previous swing low with strong momentum.

Step 1. Look for a bearish price thrust that clears below the previous swing low with strong momentum.- Step 2. Mark out a “retracement zone” between 50% and 61.8% of the price thrust.

- Step 3. After price rises up to the retracement zone, sell below bearish Pin Bar price action signal When you have a Pin Bar price action signal present on the chart.

- Stop Loss

You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. Your stop loss is above the Bearish Pin Bar tail.

Step 1. Look for a bullish price thrust that clears above the previous swing high with strong momentum.

Step 1. Look for a bullish price thrust that clears above the previous swing high with strong momentum.- Step 2. Mark out a Fibonacci “retracement zone” between 50% and 61.8% of the price thrust.

- Step 3. After price falls down to the retracement zone, buy above bullish Pin Bar price action signal When you have a Pin Bar price action signal present on the chart.

- Stop Loss

You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. Your stop loss is below the Bullish Pin Bar tail.

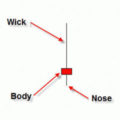

The Pin Bar Detector Indicator is a trading tool developed to help traders identify Pin Bar Patterns more easily.

How the Pin Bar Detector Indicator Works?

Pin bar Detector is a MetaTrader indicator that tries to detect Pin bars and marks them by placing a “smiling face” symbol below the bullish Pin bars and above the bearish Pinbars. It is a pure price action indicator, which is not using any standard technical indicators in its code. The configuration of Pin bar detection can be done via the indicator’s input parameters. Pin bar Detector can issue platform alerts and email alerts on detection. The indicator is available both for MT4 and MT5 versions of the trading platform.