CCI Moving Average Price Action Trading – There’s no doubt that if you want to enhance your trading accuracy in both the stock market and Forex market, then the combination of Moving Average and CCI is one of the answers you must master.

The greatness of this indicator combination lies not only in its high signal accuracy and reliable risk-reward ratio but also in its easy availability on every trading platform.

So, starting from now, after carefully following this tutorial, you’ll possess a powerful tool that you can rely on for scalping, intraday, and swing trading. So without further ado, let’s dive right into the discussion of this great strategy.

The concept behind the CCI – Moving Average Trading Strategy is straightforward as it combines a trend-following indicator with an oversold-overbought indicator.

- Moving Averages give a sense of the general trend and signal a potential change in trend when a crossover happens.

- CCI indicator serves as an oscillator indicating whether the market is in oversold or overbought conditions.

This is a combination of Moving Averages and CCI that has proven to be highly effective in beating the market, both in the stock market and the forex market.

- Download “ForexWOT-MACCIsystem” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-MACCIsystem.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-MACCIsystem” trading system and strategy.

- You will see the “ForexWOT-MACCIsystem” is available on your Chart.

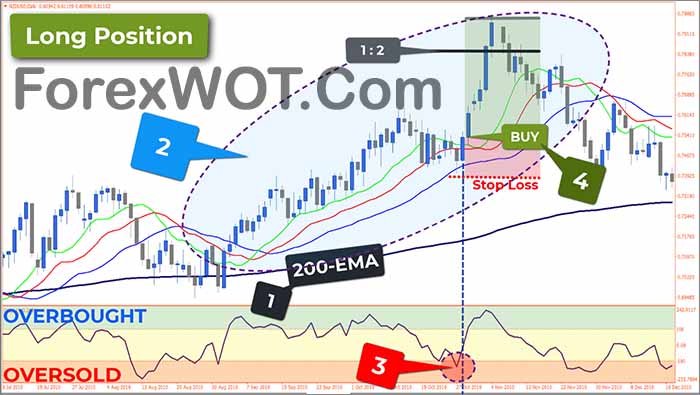

- Price is above the 200-period EMA.

- The Alligator indicator is above the 200-period EMA and shows a bullish trend formation.

- Wait for the price to pull back to the moving averages, followed by the CCI line declining and crossing below the -100 level.

- If all three trading rules are met, the Trader will initiate a BUY position when the CCI line starts moving upwards and crosses above the -100 level. To enhance the probability of success in this BUY position, we can use confirmation from bullish reversal patterns, such as Bullish Engulfing, Bullish Doji, or Bullish Pin Bar, among others.

- Once you enter the trade, you can set an initial stop loss below the recent swing low with a minimum profit target of twice the risk.

- Price is below the 200-period EMA.

- The Alligator indicator is below the 200-period EMA and shows a bearish trend formation.

- Wait for the price to rally back to the moving averages, followed by the CCI line rising and crossing above the +100 level.

- If all three trading rules are met, the Trader will initiate a SELL position when the CCI line starts moving downwards and crosses below the +100 level. To enhance the probability of success in this SELL position, we can use confirmation from bearish reversal patterns, such as Bearish Engulfing, Bearish Doji, or Bearish Pin Bar, among others.

- Once you enter the trade, you can set an initial stop loss above the recent swing high with a minimum profit target of twice the risk.

You don’t often encounter the CCI Moving Average Price Action Trading signal in trading because it’s a unique signal that, when found, almost certainly leads to profitable trades for you.

However, despite its high profitability, you still need to safeguard your trading capital by consistently setting stop losses at the nearest swing high or swing low.