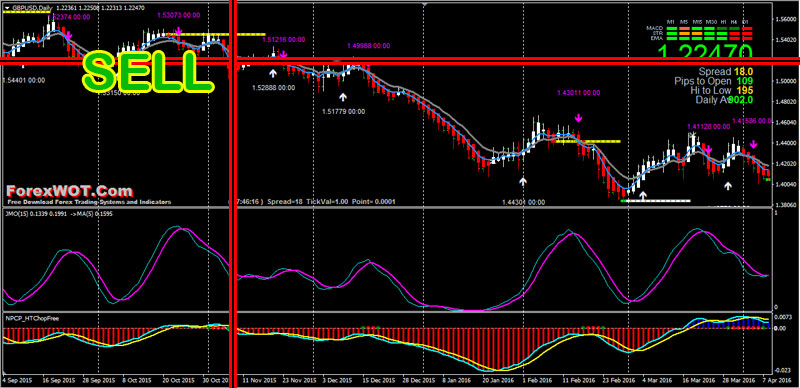

High Accuracy Forex Technical Analysis – Heiken Ashi JMO Stochastic Foreign Currency Exchange Analysis Filtered with Dynamic Support and Resistance. Any Heikin-Ashi strategy is a variation of the Japanese candlesticks and are very useful when used as an overall trading strategy in markets such as Forex.

Unlike the regular Japanese candlesticks, heikin-ashi candlesticks do a great job of filtering out the noise we see with Japanese candlesticks. They are also able to highlight the trend of the market much easier than other plotting methods.

Heiken Ashi JMO Stochastic Trading Rules

Heiken Ashi JMO Stochastic Trading System is a trading strategy based on the following indicators: Heiken Ashi and JMO Stochastic indicator but filtered with dynamic support and resistance.

This system is not holy grail but help you at the gain pips.

- Best Time frame : 15 min or higher.

- Financial markets : any

BUY Rules

- Heiken Ashi Candles white color,

- When it forms a support wait a buy arrow,

- Confirmed by jmo that crosses upward and by the choppy indicator that is not flat,

- Signal Trend green color.

SELL Rules

- Heiken Ashi Candles red color,

- When it forms a resistance wait a sell arrow,

- confirmed by jmo that crosses downward and by the choppy indicator that is not flat,

- Signal Trend red color.

Exit position is discretionary.

- But as profit target, recommended, ratio minimum 1 : 2 stop loss.

Heiken Ashi Trade Management

Note, for this trade management, you have to switch to a normal candlestick chart to do these.

The best way to get more profitable pips out of a strong trend is to trail stop your trades using subsequent lower swing highs for sell trades and higher swing lows for buy trades.

- For example

If your sell trade is profitable and price has moved favorably, place your trailing stop a few pips behind those consecutively decreasing tops o lower swing highs as the price moves lower.

Similarly, if your buy trade is profitable, place your trailing stop a few pips behind those consecutively increasing bottoms or higher swing lows as price moves higher.

The reason for using the trailing stop this way is so that you give the market room to breathe and so you do not get stopped out prematurely.