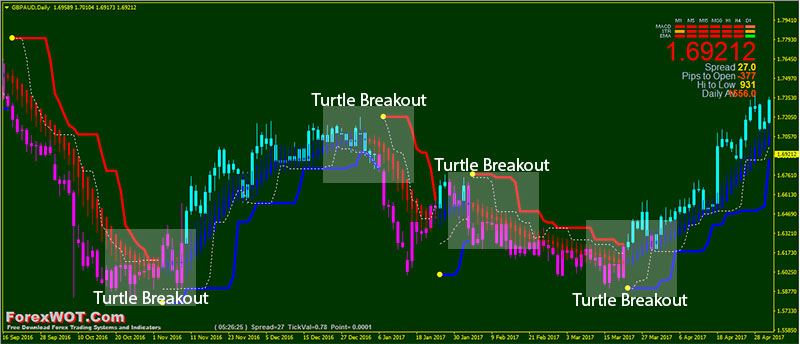

The New Turtle Trading Software and Strategy – Super simple and easy Turtle trading channel system with high accuracy filter indicators. The New Turtle Channel System is a trend following based on the original “The Turtle” trading rules.

Why is a Turtle Channel important for traders and analysts?…

Like most channel indicators, the turtle channel’s importance for traders or market analysts lies in the fact that it is helpful in identifying trend and likely trading ranges, spotting significant price movements and assessing trend strength.

The Turtle Channel is used in the technical analysis in a similar manner to other banded indicators such as Keltner channels and moving average envelopes.

A decisive price breakout from the channel most likely indicates a significant shift in market strength or direction.

In an existing uptrend, a BREAKOUT above the turtle channel is interpreted as a significant increase in upward momentum and confirms the likelihood of the uptrend continuing for a substantial period of time.

A BREAKOUT below the channel that occurs during an existing uptrend is interpreted as a bearish market reversal signal.

The Turtle Channel Breakout simple rules

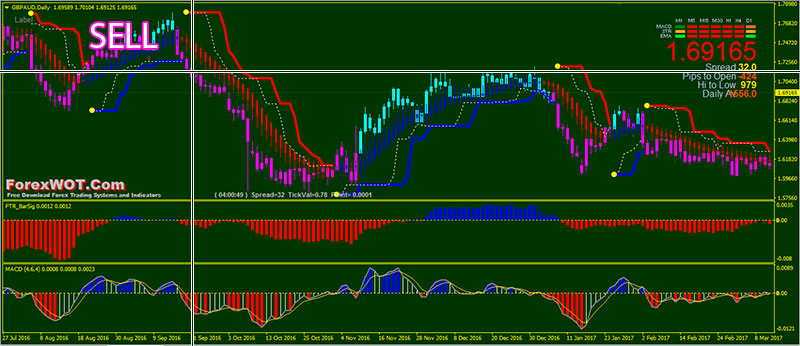

- Go LONG (BUY) when the trading line turns BLUE

- Go SHORT (SELL) when the trading line turns RED

- Exit long positions when the price touches the exit line

- Exit short positions when the price touches the exit line

However, the Turtle Channel is also used by traders as a simple trend-following indicator because it typically does a very good job of encompassing both high and low price swings within a long-term trend.

This trend following system was designed by Dennis Gartman and Bill Eckhart, and relies on breakouts of historical highs and lows to take and close trades: it is the complete opposite to the “BUY LOW and SELL HIGH” approach.

This trend following system was taught to a group of average and normal individuals, and almost everyone turned into a profitable trader.

The main rule is “Trade an N-day breakout and takes profits when an M-day high or low is breached (N must me above M)“. Examples:

- Buy a 10-day breakout and close the trade when price action reaches a 5-day low.

or….

- Go short a 20-day breakout and close the trade when price action reaches a 10-day high.

This Turtle Channel indicator should be used together with trend filter indicators.

- FTR Bars

- FTR CT

- FTR HASig

- FTR SigLine

- FTR BarSig

- FTR MACD

- Signal Trend

- Turtle Channel or FTR SigLine trading line turns BLUE

- FTR Bars (RSI Candle) aqua color

- FTR HASig blue color

- FTR BarSig blue color

- FTR MACD blue color

- Turtle Channel or FTR SigLine trading line turns RED

- FTR Bars (RSI Candle) magenta color

- FTR HASig red color

- FTR BarSig red color

- FTR MACD red color

Profit targets are set at either the centerline or the opposite band of the channel.

The New Turtle Channel Breakout Strategy had very strict money management too. Initial position risk was 2%, but it decreased according to the current drawdown.

- If the account had a 10% drawdown, the risk for each trade should decrease a 20%.

- If the account had a 20% drawdown, the risk for each trade should decrease a 40%.

- If the account had a 30% drawdown, the risk for each trade should decrease a 60%.

- So, if the account had an N% drawdown, the risk for each trade should decrease N*2%.

[sociallocker]

[/sociallocker]