THE TURTLE DONCHIAN CHANNEL: The FASTEST & Most AGGRESSIVE Trending Indicators Alternatives to the Moving Average. Turtle Channel systems are based on the method made famous by Richard Dennis in the Turtle Trader experiment of the 1980’s.

Turtle Channels look very similar to the ATR Stops. They will provide similar information much of the time, but they aren’t the same. Turtle Channels have a trading strategy built into them. They provide trade signals, as well as stop loss levels.

How to install “The Turtle Donchian Channel System“

- Download “ForexWOT-TurtleDonchianChannel” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-TurtleDonchianChannel.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-TurtleDonchianChannel” trading system and strategy.

- You will see “ForexWOT-TurtleDonchianChannel” is available on your Chart.

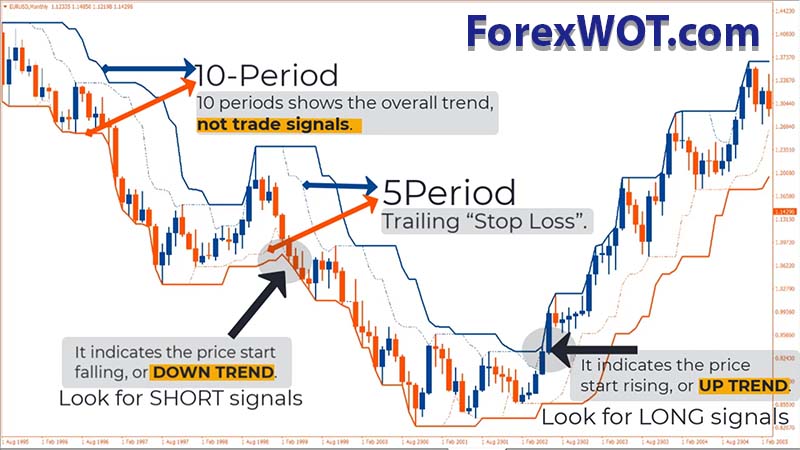

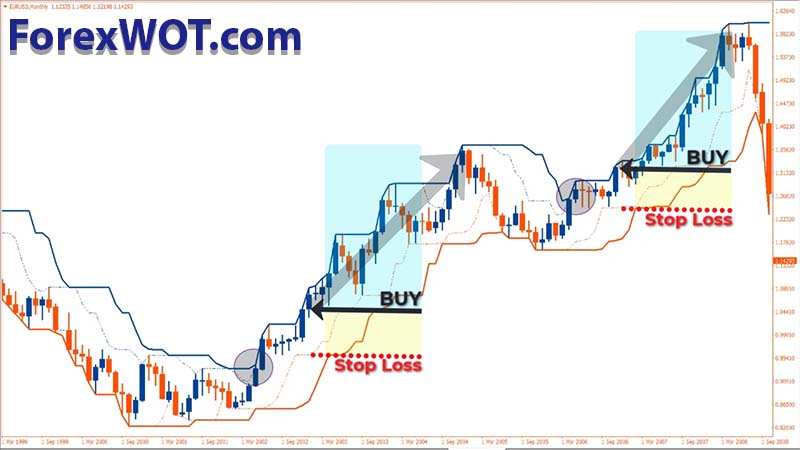

LONG TRADE SETUP

- Step #1: When the price break above the blue line (10-period Donchian Channel), it indicates the price start rising, or up trend.

- Step #2: Look for long “Price Action” signals between the blue line and the small dotted line.

Stop Loss Strategy

- If you are going long, the stop loss is placed just below the bottom of the consolidation from which you are entering long from, or use the small dotted lines as “trailing Stop”.

SHORT TRADE SETUP

- Step #1: When the price break below the red line, it indicates the price start falling, or down trend.

- Step #2: Look for short “Price Action” signals between the red line and the small dotted line.

Stop Loss Strategy

- If you are going short, the stop loss is placed just above the top of the consolidation from which you are entering the short from, or use the small dotted lines as “trailing Stop”.

Trading NOTES

- This example shows a Turtle Channel system with a 10 Trade Period, for the primary input for the red and blue lines on a GBP-USD chart.

- 10 periods shows the overall trend, not trade signals. If using the indicator for trade signals, a Trade Period of about 5 is used. in this case, The small dotted lines indicator is 5 period Turtle Channels.