FREE DOWNLOAD RSI Kijun-sen Forex Trading System And Strategy – Hello all. I’m back for the second time to bring you another trading method of mine, also taken from my Ichimoku trading series.

This is actually the third of the 3 part series. Please feel free to ask questions, give your opinions and make any suggestions.

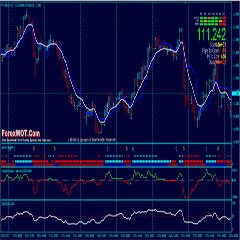

RSI Kijun-sen Forex Trading System And Strategy

Hopefully I will have more to submit in the future. My main purpose is to help other newbies (like myself) find their path in the FX world!! So, with that being said i would like to present to you…”Next Stop”!

I’m looking forward to hearing your comments!! 🙂

Indicators:

- Kijun-sen (52, shift 3)

- Tenkan-sen (9, shift 0) Daily Chart Only for possible daily pullback level

- RSI (26)

- Trend lines (S/R Levels)

Timeframes Used:

- Daily (Recognize General Trend)

- 4 Hour (Get S/R Levels, Kijun-sen Level & Intraday Trend)

- 1 Hour (Entry/Trade Management)

Daily Chart (General Trend):

- Mark the previous day’s high/low price

- If Tenkan-sen is above Kijun-sen and price is above both lines the market is in an uptrend

- If Tenkan-sen is below Kijun-sen and price is below both lines the market is in a downtrend

- If price is between Tenkan-sen and Kijun-sen the market is undecided

4 Hour Chart (Support and Resistance Levels):

- Mark all major and minor support and resistance levels from this timeframe

- If price is above 4 Hour Kijun-sen look for long entries, if price is below 4 Hour Kijun-sen look for short entries

1 Hour Chart (Entry & Trade Management):

Go LONG

- When price crosses Kijun-sen from below, closes above it and RSI is above 50.

- When price comes down, tests and rejects Kijun-sen from above and RSI is above 50.

- When price tests, rejects and forms a pin bar at a support level.

- Solar Wind Joy GREEN

Go SHORT

- When price crosses Kijun-sen from above, closes below it and RSI is below 50.

- When price moves up, tests and rejects Kijun-sen from below and RSI is below 50.

- When price tests, rejects and forms a pin bar at a resistance level.

- Solar Wind Joy RED

- Pin bar = hammer, hanging man, inverted hammer, shooting star and doji

Exit Strategy:

- Exit when price crosses Kijun-sen in the opposite direction.

- Exit when profit target is hit.

- Exit when stop loss is hit.

- Exit when trailing stop is hit.

RSI Kijun-sen Forex Trading Risk Management

Option #1 (My personal favorite):

- Place a 40 pip stop loss

- Place a 60 pip trailing stop

- Move stop to breakeven plus spread after price moves +40 pips

- Pullback Entries (Add 34 EMA Median)

- When price pulls back, tests, rejects and closes in the direction of the trend and RSI is above 50 then it is a valid scale-in/add-on entry

- 1st position should have a 40 pip stop loss, 120 pip target and 60 pip trailing stop

- All other positions should have a 40 pip stop loss, 80 pip target and 40 pip trailing stop

Option #2 (recommended for newbies):

- Place a 40 pip stop loss

- Place an 80-120 pip profit target (2:1 to 3:1 reward to risk ratio)

- Place a 60 pip trailing stop

- Move stop to breakeven plus spread after price moves +40 pips

Option #3:

- Place two (2) half-sized positions

- Place a 40 pip stop loss on both positions

- Place an 80 pip profit target and 60 pip trailing stop on the first position

- Place an 80 pip trailing stop on the second position