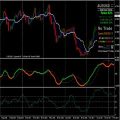

How to Filter Good & Bad Entry Signals : Forex Tenkan-Sen Kijun-Sen Mega Trend Strategy With High Accuracy Trading Filter Indicators. There is obviously a plethora of variables and influences that affect a trader’s decision making process when analyzing a chart, finding a trading signal and then executing a trade.

Today I am going to talk about the main challenge in this process; How to Filter Good & Bad Entry Signals. Forex Tenkan-Sen Kijun-Sen Mega Trend Strategy With High Accuracy Trading Filter Indicators is the best answer.

Tenkan Sen – Kijun Sen

The entry for the tenkan sen/kijun sen cross is very straightforward – an order is placed in the direction of the cross once the cross has been solidified by a close.

Nevertheless, in accordance with good Ichimoku trading practices, the trader should bear in mind any significant levels of support/resistance (ex. EMA 200, EMA 100, and EMA 50 – as MEGA TREND Indicators) near the cross and consider getting a close above those levels before executing their order.

Forex Tenkan-Sen Kijun-Sen Mega Trend Trading Rules

Forex Tenkan-Sen Kijun-Sen Mega Trend Trading System and Strategy is a complete strategy trend momentum with more high accuracy filter indicators.

You can trade intraday or swing. This strategy is discretionary.

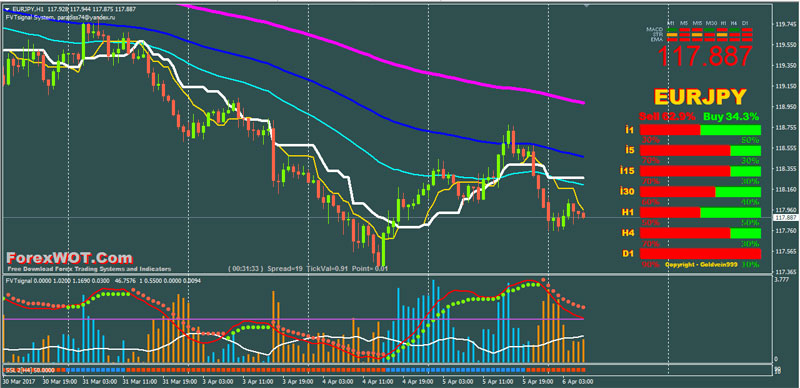

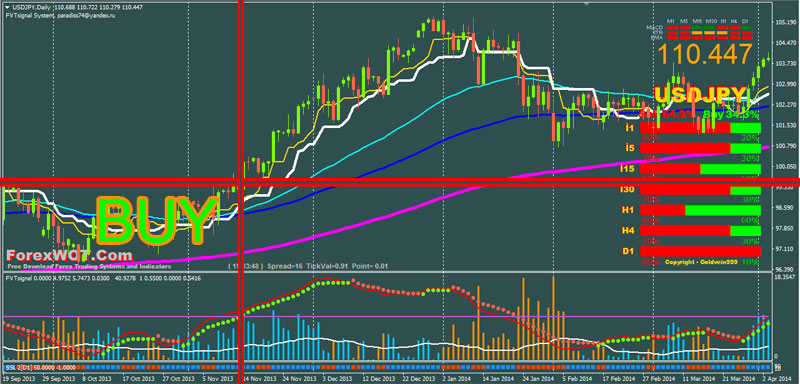

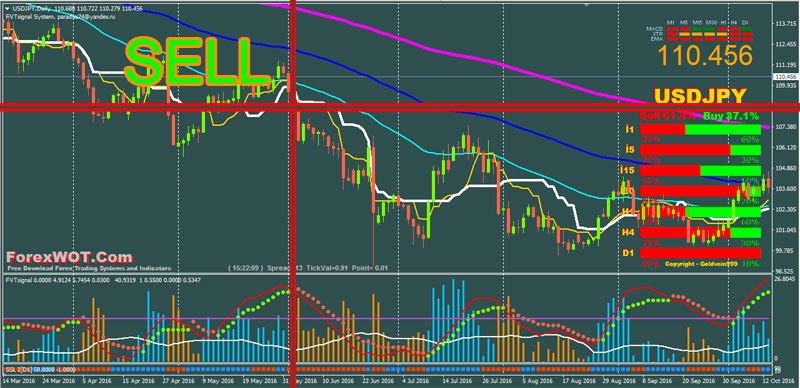

- Best Time Frame : H1 min or higher

- Financial Markets : Indicies, Currency pairs and Commodities

Metatrader Indicators

- Ichimoku Kinko Hyo (Tenkan-Sen Kijun-Sen)

- Moving average 200 period,

- Ema 100 close,

- EMA 50 close,

- Signal Trend,

- Strength Candles > 60,

- FVT Signal,

- 1 indicator,

- 2 indicator,

- volatility qualitiy nrp, (optional)

- Ssl Fast. (optional)

BUY Rules

- Ichimoku Kinko Hyo (Tenkan-Sen line upward above Kijun-Sen line)

- EMA 50 close upward above EMA 100 close,

- Ema 100 close upward above EMA 200 close

- Signal Trend green

- Indicator 2 green dot

- FVT Signal aqua bar

SELL Rules

- Ichimoku Kinko Hyo (Tenkan-Sen line downward below Kijun-Sen line)

- EMA 50 close downward below EMA 100 close,

- Ema 100 close ownward below EMA 200 close

- Signal Trend red

- Indicator 2 red dot

- FVT Signal red bar

EXIT Rules

- Exit position is discretionary,

- or Use EMA 100 trailling exit

Stop-Loss Placement – The tenkan sen/kijun sen strategy does not dictate use of any particular Ichimoku structure for stop-loss placement, like some other strategies do.

Instead, the trader should consider their execution time frame and their money management rules and then look for the appropriate prevailing structure for setting stop-loss.

[sociallocker]

[/sociallocker]

Все лучшее враг хорошего!