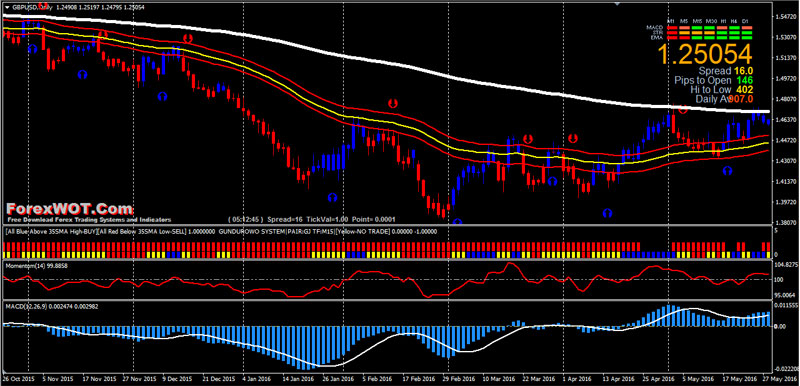

Best and Easy Forex MACD Trading System – Traders looking to trade trends with MACD may feel very ‘at-home’ with the indicator, as MACD is generally utilized as a mechanism to enter into trending situations.

MACD is a very logical indicator, and it does just what the name describes: It measures the spatial relationship of 2 Exponential Moving Averages.

The most common default inputs for MACD are using EMA’s of 12, and 26 periods – along with the ‘signal’ line of 9 periods.

For now – let’s just focus on the MACD line itself, which is simply the difference between the 12, and 26 period EMA (using default inputs).

Forex MACD System Rules

Forex MACD Trading System is a Forex trend following trading strategy based on the MACD, Moving Average, and Momentum indicator.

MetaTrader Trading Indicators

- MACD

- Momentum, ( Recommended momentum trading system FREE DOWNLOAD Best 7 Momentum Trading Systems )

- Exponential moving average 50 period high,

- Exponential moving average 50 period low,

- Exponential moving average 50 period close,

- Exponential moving average 200 period close,

- Arrow Buy and Sell,

- MA Candles (2, 8),

- Gundurowo System ( Burdys and Buird),

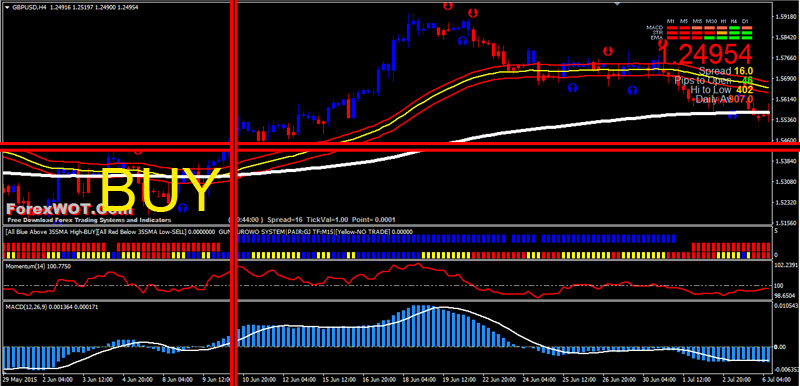

BUY Rules

- Blue candle bar closes above 50 EMA high line (you will receive alert)

- 50 EMA above EMA 200

- MACD histogram above 0 line

- Momentum indicator line upward above 100 level

- FGF_BURDYS and FGF_FBURD indicators draw blue bar

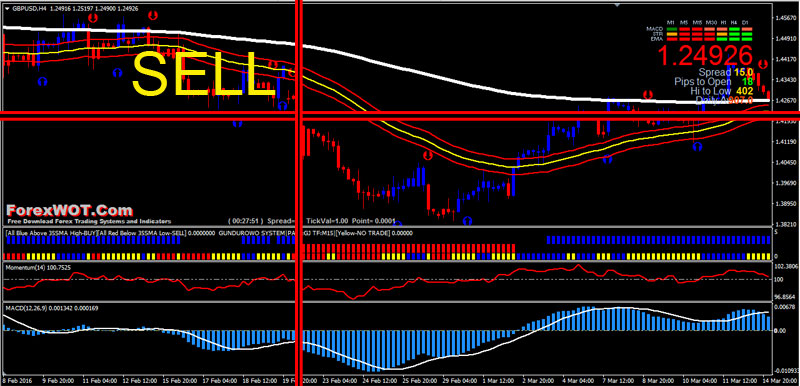

SELL Rules

- Red candle bar closes below 50 EMA low line (you will receive alert)

- 50 EMA below EMA 200

- MACD histogram below 0 line

- Momentum indicator line downward below 100 level

- FGF_BURDYS and FGF_FBURD indicators draw red bar

EXIT Rules

- Exit trade when indicators turns agaist your trade direction.

- Trailing stop could be applied, stop loss for it depends on timeframe.

- Stop loss should be placed at previous low or high.

Recommendation not to risk more than 2% of your initial capital per trade.

Tips: Find the currency pair in trend and trades only in the direction of the major trend.

Trading Note

While a MACD can be traded on its own, using price action to provide a context for trades is often prudent. ( Recommended article Forex Price Action Trading System )

Just because a stock or currency pair flashes a bullish crossover doesn’t mean it is a good buy–for example if the trend is down.

Instead, it may be better to wait for a bearish crossover and trade in the direction of the down trend.

No matter what method is used, losing trades will occur.

Therefore, establish risk and position size parameters before the trade based on your personal risk tolerance.

hay this strateqiy 200 ema and ema50 but instructions that ma 35 what they are