Fiji Forex Day Trading System – Short-Term trading is not easy; traders need to plan their approaches. Simple & High Profits Forex Day Trading Strategy (Fiji Day Trading System) is a highly recommended trading system for Day Trading.

Day trading is not all that complicated once you learn a simple, rules-based strategy for anticipating market moves.

FIJI Forex Day Trading System Rules

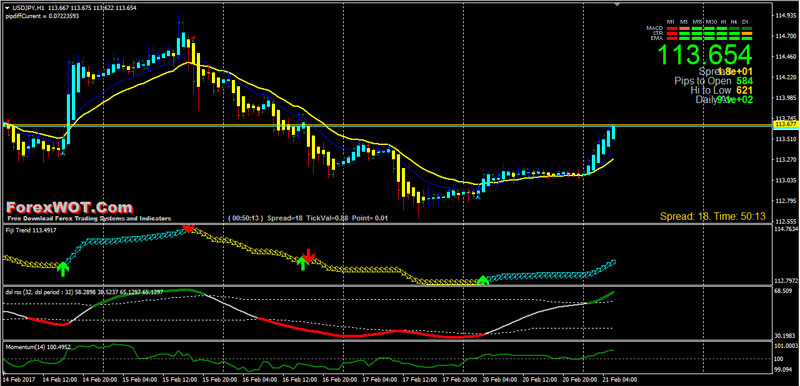

Fiji Day Trading System & Strategy is an IntraDay (Short-Term Trading) reversal-trend strategy based on Fiji indicator, Heiken Ashi, and Momentum.

This strategy works with range market, short trend and medium trend. When the market is very trending, this strategy falls.

- Best Time frames : 15 min, 30 min, and 1 Hour.

- Financial market: any.

BUY Rules

- When blue line BUY-SELL Signal above yellow line BUY-SELL Signal

- Buy arrow of the Fiji trend

- Heken Ashi aqua bars

- DSL Signal Line green

- Momentum line upward and above 100 level

- Signal Trend green bars

SELL Rules

- When blue line BUY-SELL Signal below yellow line BUY-SELL Signal

- Sell arrow of the Fiji trend

- Heken Ashi yellow bars

- DSL Signal line red

- Momentum line downward and below 100 level

- Signal Trend red bars

EXIT Position

- Place initial stop loss above/below the band.

- Profit target on the middle band or with predetermined profit target.

Forex Day Trading Notes :

- Be patient

Paradoxical though it may seem, successful day traders often don’t trade every day. They may be in the market, at their computer, but if they don’t see any opportunities that meet their criteria they will not execute a trade that day.

That’s a lot better than going against your own best judgment out of an impatient desire to “just do something.” Plan your trades, then trade your plan.

- Never risk too much capital on one trade.

Set a percentage of your total day trading budget (which might be anywhere from 0.5% to 2%, depending on how much money you can afford to lose) and don’t allow the size of your position to exceed it.