HOW TO TRADE THE MARKET WITH DOUBLE BOLLINGER BANDS.

The two main strategies to employ using Double Bollinger Bands involve breakouts and trend trading.

The Double Bollinger Band strategy can be applied when trading breakouts of an existing trading range by observing a break above or below the range, combined with a strong break into the DBB buy zone or DBB sell zone. Witnessing strong breaks provide a greater bias in favour of the breakout as traders look to avoid a false breakout.

Here are some examples of a Double Bollinger Band breakout strategy.

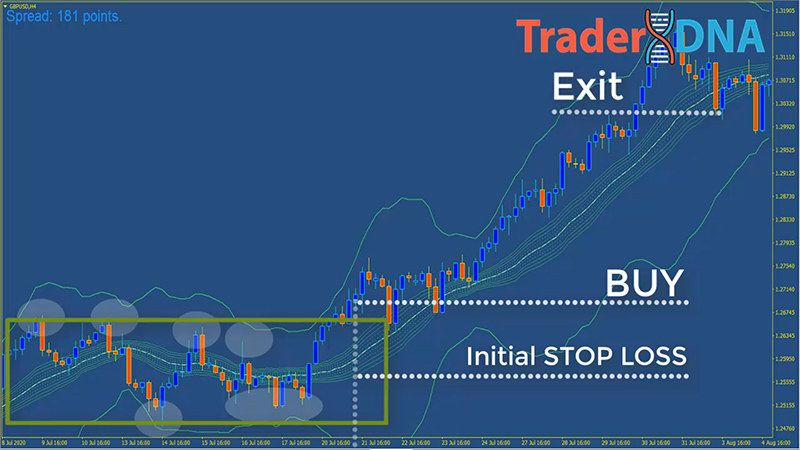

The Double Bollinger Band trend trading strategy allows traders to assess the momentum of an existing trend. It allows traders to exit on a slow-down or add to existing positions when momentum and volatility increase.

In this case, as long as price remains between the sell zone and the 20 SMA zone, traders can maintain the short bias.

The exit point can either be on a close above the 20 SMA zone or depending on the level of risk tolerance. Those using the mid-line as a stop can manually move their stops along the 20 SMA as price rises.

Here are some examples of Double Bollinger Band Breakout Trading