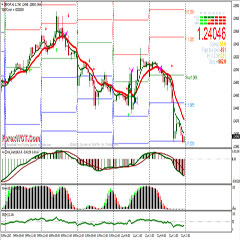

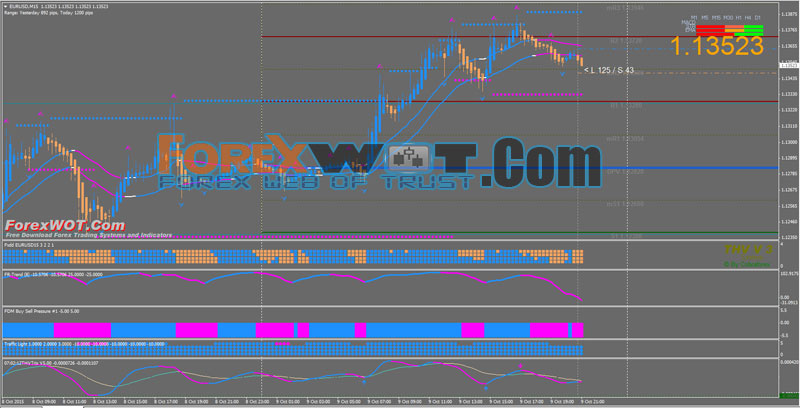

This trading system is a trend following strategy based on trending indicators. This is a combination of filters. For best result you can use Pivot points.

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day. On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

A pivot point analysis is often used in conjunction with calculating support and resistance levels, similar to a trend line analysis. In a pivot point analysis, the first support and resistance levels are calculated by using the width of the trading range between the pivot point and either the high or low prices of the previous day. The second support and resistance levels are calculated using the full width between the high and low prices of the previous day.

Time Frame: 30 min, 60 min, 240 min.

Currency pairs: majors.

- NRP arrow,

- Pivot Indicator

- Hiper Fractal

- Dashboard,

- FX-Trendlines,

- Heiken Ashi,

- FR Trend,

- FDM Buy Sell Pressure,

- Trix Kids defaul setting.

When appears the NRP buy arrow wait these conditions for entry market:

- Fr Trend line aqua color,

- Heiken Ashi aqua color,

- FR Trend aqua color,

- Trix Kids green lines.

Pivot Trading Rules For BUY

- Identify bullish divergence at the pivot point, either S1, S2 or S3 (most common at S1).

- When price rallies back above the reference point (it could be the pivot point, S1, S2, S3), initiate a long position with a stop at the recent swing low.

- Place a limit (take profit) order at the next level (if you bought at S2, your first target would be S1 … former support becomes resistance and vice versa).

When appears the NRP sell arrow wait these conditions for entry market:

- Fr Trend line Magenta color,

- Heiken Ashi brown color,

- FR Trend brown color,

- Trix Kids red lines.

Pivot Trading Rules For SELL

- Identify bearish divergence at the pivot point, either R1, R2 or R3 (most common at R1).

- When price declines back below the reference point (it could be the pivot point, R1, R2, R3), initiate a short position with a stop at the recent swing high.

- Place a limit (take profit) order at the next level. If you sold at R2, your first target would be R1. In this case, former resistance becomes support and vice versa.

Exit position with profit target predetermined or make profit with ratio 1:1.2 , initial stop loss on the previous swing.

[sociallocker]

[/sociallocker]