Forex CCI Fibonacci Retracement Trading – The commodity channel index (CCI) is an oscillator originally introduced by Donald Lambert in 1980.

Since its introduction, the indicator has grown in popularity and is now a very common tool for traders in identifying cyclical trends not only in commodities, but also equities and currencies. The CCI can be adjusted to the timeframe of the market traded on by changing the averaging period.

Understanding the CCI Like most oscillators, the CCI was developed to determine overbought and oversold levels. The CCI does this by measuring the relation between price and a moving average (MA), or, more specifically, normal deviations from that average. The actual CCI calculation, shown below, illustrates how this measurement is made.

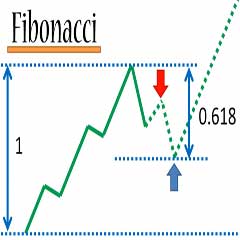

The Fibonacci retracement is the potential retracement of a financial asset’s original move in price. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction. These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

Fibonacci retracement is a very popular tool used by many technical traders to help identify strategic places for transactions to be placed, target prices or stop losses.

The key Fibonacci ratio of 61.8% – also referred to as “the golden ratio” or “the golden mean” – is found by dividing one number in the series by the number that follows it. For example: 8/13 = 0.6153, and 55/89 = 0.6179.

The 38.2% ratio is found by dividing one number in the series by the number that is found two places to the right. For example: 55/144 = 0.3819.

The 23.6% ratio is found by dividing one number in the series by the number that is three places to the right. For example: 8/34 = 0.2352.

The pivot point is simply the average of the high, low and closing prices from the previous trading day. On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

When calculating pivot points, the pivot point itself is the primary support/resistance. This means that the largest price movement is expected to occur at this price. The other support and resistance levels are less influential, but may still generate significant price movements. Pivot points can be used in two ways;

- The first way is for determining the overall market trend: if the pivot point price is broken in an upward movement, then the market is bullish, and vice versa. Keep in mind, however, that pivot points are short-term trend indicators, useful for only one day until it needs to be recalculated.

- The second method is to use pivot point price levels to enter and exit the markets. For example, a trader might put in a limit order to buy 100 shares if the price breaks a resistance level. Alternatively, a trader might set a stop-loss for his or her active trade if a support level is broken.

Pivot points are yet another useful tool that can be added to any trader’s toolbox. It enables anyone to quickly calculate levels that are likely to cause price movement. The success of a pivot-point system, however, lies squarely on the shoulders of the trader, and on his or her ability to effectively use the pivot-point systems in conjunction with other forms of technical analysis. These other technical indicators can be anything from CCI and MACD crossovers to candlestick patterns – the greater the number of positive indications, the greater the chances for success.