We often hear the distinction between technical trading and fundamental approach. Technical trading refers to trading decision based on direct price movements. While on the other side, fundamental approach is associated with trading decision based on the economic data publications .

Economic data publication always affect market movements. Yet many of us, especially technical ones, don’t put any attention on it. Well, its ok though, that technical traders don’t pay attention much on it. But it is so unfortunate. As economic data publication will create volatility at which traders are looking to gain from.

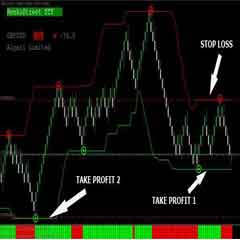

Trading is about timing. And timing is about the volatility. Trust us, there will be no volatility without the publication of economic data. That is why fundamental data (and its publication time) will somehow keep your trade efficient (see the example of economic data on trading here).

The Most Affecting Publication

If you are technical traders, please bear in mind that the timing of volatility is what you are looking for from economic data publication. Thus, as the publication of economic data occurs almost every day, we need to avoid the noise and focus on “the most affecting publication”. Fundamental data as the basic one.

They are: employment, inflation, and interest rates.

[1] Employment

Employment means the engine of an economy. When a country’s employment is high, society earn more money. If they earn more money, they will spend more on buying things (as buyer). When they spend more, sellers are getting rich. Conclusively, this creates a circle of economic development of a country. Thus, market are favour for the investment to them. More investment creates more demand of the currency. You got it?

Therefor, as a trader, we are keen to know how an employment level of a country has been going so far. And, digging deeper, we need to understand what indicators affect the employment level. Take this for easy read, retail sales, manufacturing production, jobless claims, and the unemployment level itself. This data usually published once to twice a month. Differ between countries.

In US, the most affecting data is unemployment level which published every once a month. While in UK, retail sales and manufacturing hold the importance of GBPUSD movement.

[2] Inflation

Inflation is an indexed price level of a country. High inflation means things are getting expensive, and otherwise. A more expensive stuff means two things. First, economy is running well as many people buying this and that causing price to skyrocket. But this also means second, the money within the country is losing their value. Why? Because, if previously USD 10 worth 2 apples, due to inflation, USD 10 can now worth only 1 apple.

Inflation is good at certain level. Because inflation creates room for business to grow. But exaggerating inflation will provide heat on economy and lessening the value of its money (Overheating economy). Traders and investors look at this number as it shows the signal of interest rate movement. At this point, inflation means a lot for traders because they affect so much on Central Bank decision.

Inflation data is commonly published once a month. The figure could be monthly and yearly.

[3] Interest Rate

This is the holly wholly of market movement. Interest rate is money’s price. Interest rate is used by Central Bank to control money circulation. How is that be going? Higher interest rate means higher money’s price. Higher money’s price will hold the economic growth. In the end of the day, Central Bank control the economy through money circulation via interest rate decision.

Technically, in controlling their interest rate, Central Bank will firstly announce its benchmark interest rate. This benchmark interest rate is a target in which they will absorb or spurred the money into the economy until the expected rate achieved. Central Bank doing this by selling or buying Government Bonds, or Banks’ compulsory reserve requirements – that is, how much money each bank has to deposit to the Central Bank.

Interest rate usually announced once a month to three months. Depends on the country policy. Or the urgent economic turn.

What can we do for these?

Let’s make it easy. As traders, you don’t have to be so clever and sharp in economic data analysis. Just pay attention on those three, look at their publication schedule, and… expect for volatility for you to gain at. Good luck!