Making Money in Forex is Easy. Recommended pair is EUR/USD and the recommended time frame is 1 hour.

Generally speaking, you shouldn’t risk more than 5% of your trading account at any time for any reason. If you are using manual money management ( lot size ) then please make your calculations carefully and use the correct lot size for your account.

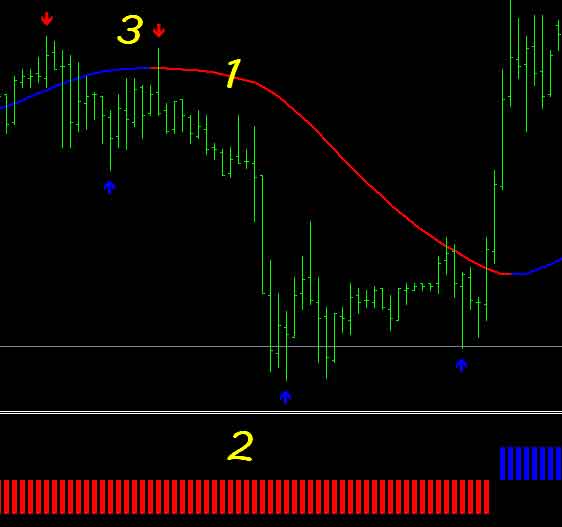

1 – Blue Trend Line

2 – Blue RSI Bar

3 – Blue Arrow

Example…

1 – Red Trend Line

2 – Red RSI Bar

3 – Red Arrow

Example…

Stop Loss: Last Arrow Level ( entry arrow )

Target : Opposite Signal

Example…

For Targets, you can also use Fixed number of pips per trade or you can use support and resistance levels or Fibonacci levels.

You will find Fibonacci indicator with the system, here is how it looks like on chart…

You can use this indicator for target areas.

Upper red area = Buy targets

Lower Blue area = Sell targets

To forex traders, everything revolves around pips.

“I’m up 35 pips for the day.”

“I made a 127 pip profit on my last trade.”

That’s great, but what’s a pip?

Pip is short for “percentage in point” and you may sometimes hear people refer to pips as points. Put simply, a pip is the smallest unit of price for a currency. It’s the last decimal point in every exchange rate or currency pair.

For most currencies its 0.0001.

So if you bought USD/CHF 1.2475 and sold at 1.2489 you made 14 pips.

One common exception is USD/JPY. In this currency pair there are only two decimal places so a pip is

equal to 0.01.

The reason pips are so important is because they are the basis for calculating profit or loss.

With all these different currency pairs to deal with and with prices fluctuating all the time, how do you know the value of a pip?

It’s a simple calculation. For currency pairs in which USD is the base currency, just divide a pip (usually 0.0001) by the exchange rate.

For currency pairs in which USD is the quote currency, its even simpler. The pip value is always one pip

(for example, 0.0001).

So in our example above, when the exchange rate for USD.CHF is 1.2489:

0.0001 / 1.2489 = 0.0000800704

That’s a pretty tiny number. But remember that in forex trading you are able to leverage small sums of money to move large quantities of currency.

In other words, you can use leverage to make big profits off of that tiny number.

Let’s say your broker allows you to trade with leverage of 100:1. This means that in order to buy a standard lot of $100,000, you only need to put up $1,000.

You can see how trading in larger lots affects the pip value, and therefore your profit or loss:

If you are only trading $1,000 in currency, the pip value is calculated as follows:

0.0000800704 X 1000 = $0.08 per pip.

The price would have to go up by a whole lot of pips in order to make a significant profit at that rate. That 14 pip profit only made you $1.12.

But by using leverage to buy a lot size of $100,000 your profit increases.

0.0000800704 X 100,000 = $8.01 per pip. That’s a profit of $112.14. Now you’re talking.

Being able to trade on margin is one of the greatest advantages of forex trading. You can purchase large quantities of currency while only putting up a small fraction of the full value.

You may hear some people refer to “leverage trading” and other to “trading on margin“. In forex trading, they refer to the same thing, just in different terms.

Leverage is usually quoted as a ratio such as 100:1.

This simply means that you can trade 100 units of currency while only putting up 1 unit. In other words you would only need to put up $1,000 in order to trade $100,000.

Margin is the same thing, just from a different point of view.

Margin is generally quoted as a percentage such as 10%. In this example you would be able to trade $10,000 of currency while only putting $1,000 down.

Successful forex traders use margin to explode their profits. Since the value of a single pip is quite low, you have to trade large lots of currency to make a profit.

Being able to make leveraged trades enables small investors without a lot of capital to make big profits.

However, margin cuts both ways and you must use it wisely or you’ll find yourself broke in no time.

When you first open an account with a forex broker you will be required a minimum amount of funds into the account before you can trade. The minimum account value varies from one broker to the next.

When you make a trade, part of your account balance is earmarked as the initial margin requirement for that trade.

Let’s look at an example…

You open an account and deposit $10,000 into it. You then make a trade at 100:1 leverage. You buy $100,000 of currency, but are only required to put up $1,000. So you now have $1,000 in used margin and another $9,000 in available margin.

It’s important to keep track of how much margin you have available. If prices move against you, some of the $9,000 you have as usable margin will be used to compensate for your losses.

If your balance falls too low, the broker will liquidate your positions and you will be hit with a big loss. This does however prevent you from losing more than you could if they left your position open and prices continued to go against you.

No one wants to receive the dreaded margin call. But you can effectively eliminate it by using stop-loss orders to cut your losses before they near the point of liquidation.

Pretty much any online forex broker you choose will have a trading platform that automatically calculates your

profits and losses for you. But I think it’s important to understand the basic math behind it. It’s a good way

to make sure your broker is honest, plus it’s just good to know.

Besides, calculating profit and loss is really simple. There’s only two simple formulas to remember.

When USD is the quote currency (the second currency in a pair), the formula is:

Profit = Price Change in Pips X Units Traded

When USD is the base currency (the first currency in a pair), the formula is:

Profit = Price Change in Pips X Units Traded / Exit Price

Let’s look at some real-life examples to help you understand….

First we’ll look at an example when USD is the quote currency. To keep things simple we’ll assume the broker requires 1% margin, which means you can trade $100,000 in currency for only $1,000.

So let’s say you are looking at EUR/USD which is currently trading at 1.2518/9. You predict the euro will rise in

value against the euro so you execute a trade to buy euros, which means you also simultaneously sell USD.

You buy $100,000 units at 1.2519. Remember since you are buying you have to take the ask price, which is the second number in the quote.

Your calculations are correct and the price rises to 1.2532/3.

You initiate a trade to sell EUR and buy USD. This time you use the bid price, which is 1.2532.

Since you bought at 1.2519 and sold at 1.2532 your profit was 17 pips, or 0.0017. Now we need to convert that into real money.

So take your formula above:

Profit = Price Change in Pips X Units Traded

Or,

Profit = 0.0017 X 100,000 = $170.00

An easy rule to remember is that when trading a standard sized lot (100,000) of a currency pair in which USD is the quote currency, a pip is always equal to $10. 17 pips equals $170.

Now, let’s look at an example where USD is the base currency…

We’ll execute a buy of 100,000 units of USD/JPY at 117.22. The price rises and we sell at 117.35. We just made 13 pips.

To calculate our profit we use the second formula:

Profit = Price Change in Pips X Units Traded / Exit Price

Or,

Profit = .13 X 100,000 / 117.35 = $110.78.

Nice and simple.

The arrows appear 3-4 candles back