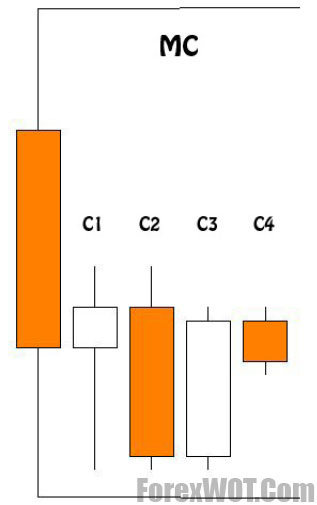

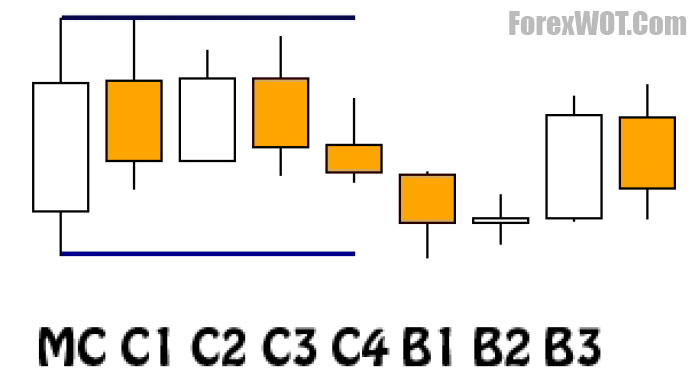

A Master Candle is simply a candle’s high and low which engulfs the next four candles’ high and low. I like to call the formation of a True Master Candle (MC).

A quick run through of the above image, the MC = Master Candle is formed when C1 = Candle One, C2 = Candle Two, C3 = Candle Three, C4 = Candle Four are inside of the master candle.

We are looking to trade a breakout of the master candle formation “A breakout is when prices pass through and stay through an area of support or resistance.”

The main reason I like the master candle formation is that it represents the time in the market where price falls into a tight range for a normally short period of time.

We are looking only to trade True Master candles like in definition above.

The main reason for this is they provide a clear pattern and breakpoint plus over the long term better results. (From my experience)

- NOTE: We are looking to only trade master candles on a 60min chart.

We are just looking at just two pairs which are GBP/USD and GBP/JPY.

On these pairs, we are first looking for a master candle to form and after that, we are looking to trade the break of master candles high or low.

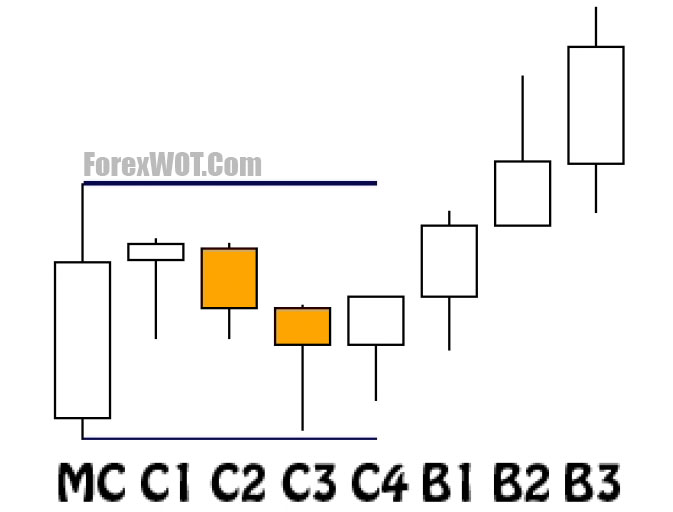

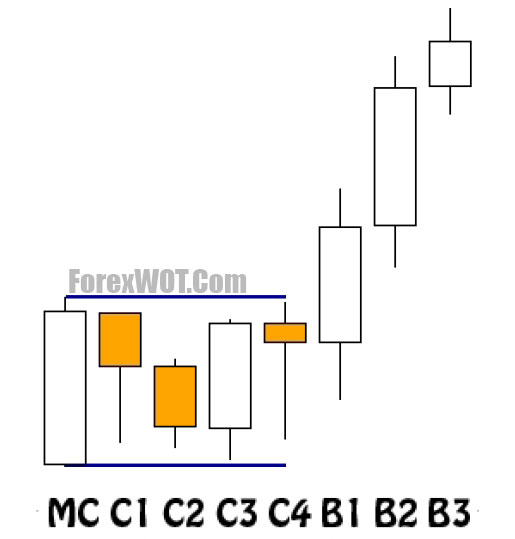

For the trade to be valid the break of the master candle high/lows must occur in the next three candles.

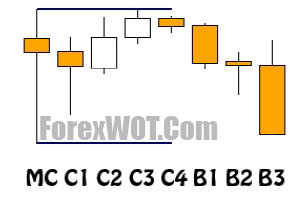

Let’s break this down into a simple statement:

MC C1 C2 C3 C4 | B1 B2 B3

Now for the picture worth a thousand words.

We have added to our statement B1 B2 B3 which stands for Break One, Break 2 Two, Break Three.

The trade is ONLY valid if the break happens on one of the B1 B2 B3 candles.

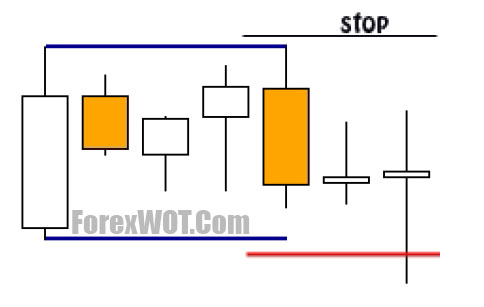

If it does not like the picture above it is a null trade.

The above picture is an example of a null trade where the break of the master candle did not happen within the B1 B2 or B3 candles.

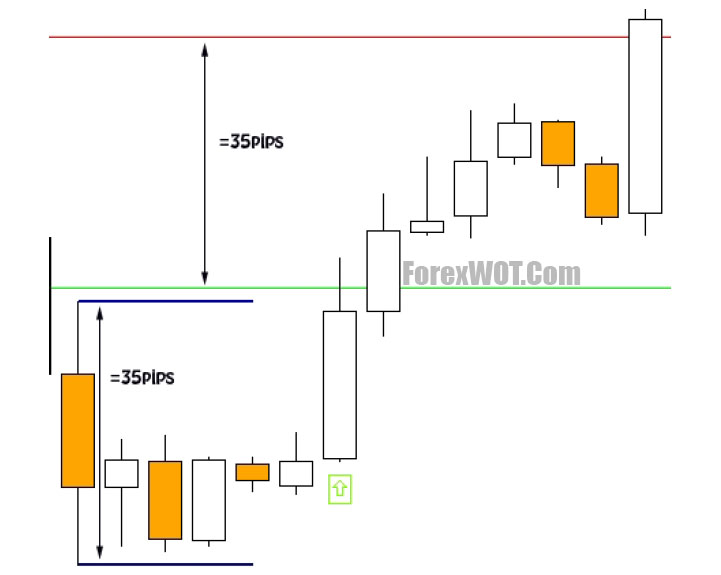

The above picture is an example of a successful break of the master candle which happened on the B2 candle. (Long position)

The above picture is an example of a successful break of the master candle which happened on the B1 candle. (Long position)

Every method has rules and this one is no different. But remember rules are meant to be broken (sometimes).

- No Trading into an SR (Support/Resistance) zone

- If the SR zone is closer than the size of the Master Candle then no trade.

- Trade only on the B1 B2 B3 Candle’s breaking the MC High/Low

GBP/USD and GBP/JPY

- Trade Master Candle sizes between 40-105 pips

- If Master Candle is greater or less than the above sizes then no trade.

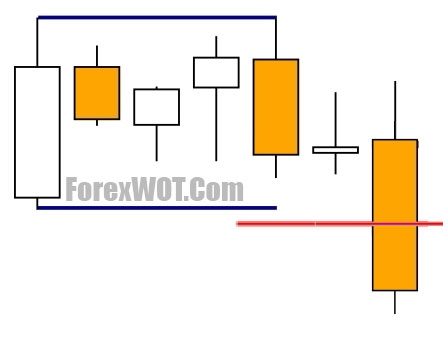

The most important part of the method.

Longs:

5 pips above the Master Candle High + Spread. As you can see in the picture below the green line was our long entry

Shorts:

5 Pips below the Master Candle Low. As you can see in the picture below the red line was our short entry

If you want to make money you need to close your trade at some point.

Profit Targets:

Profits will vary in pip from pair to pair but as a general rule, you want to target the size of the Master Candle.

So if the size of the master candle is 35pips we set our profit target at a minimum of 35pips as the example below.

Now saying this it is very important that we base our target on price movement over a strict rule of Master Candle size.

So if the next price area that you can see a turn around is 80pips away then you should be targeting there.

Stops are meant to be used to give you the MAXIMUM possibility to win in your trade.

Their placement will also clearly show you that your direction was incorrect. With this in mind, the stops are placed on the other side of the master candle entry.