FREE DOWNLOAD Ichimoku Cloud H4 D1 Trading System – Forex High Accuracy D1 (Daily Timeframe). I will share with you my Ichimoku Kumo trading strategy which I use in D1, H4 chart. This strategy is very simple and you have to learn it through practice.

Before I start further I want to say that my strategy is not any scam or get rich quick strategy. So you have to learn it through hard work. I appreciate comment and discussion in this trading system.

The Use of the Ichimoku Kumo (Cloud)

The Kumo is typically looked at in terms of support and resistance; if it is thick, then the support/resistance is strong (depending on the position of price in relation to the cloud).

By contrast, if it is thin, then the S/R levels are considered weak.

Generally, if the price is above the Kumo, then there is an uptrend in place and/or more buying opportunities.

If the price is below the Kumo, then it is under resistance and it is better to be looking for shorts instead of longs.

The longer price action stays above or below the Kumo, the stronger the trend and the more support/resistance the Kumo offers.

The Kumo can be very effective for option traders as well as the trend/momentum traders.

This is because price will stay on one side of the Kumo during a trend. The farther the price action is from it, the stronger the trend and more volatile it is.

Forex Ichimoku Cloud Trading Rules

ForexWOT Ichimoku Cloud Trading System is a treding system trend following price action based on Icimoku Cloudm, Gold vein indicator, carmen eyes and a repaint indicator (similar at the Fisher indicator).

- Best Time Frame : H4 and D1

- Currency pairs : majors.

Forex Metatrader Indicators & setting:

- Ichimoku Kumo

- easy-forex-system alias carmen eyes indicator (expand rate: 35, 50, 65, trend indicator);

- Fischer Joker (21 period);

- Fishrer joker (13 period);

- Smfischer Transform (8 period);

- Gold Vein ( trend period 50 this indicator is similar at the trend CCI, trend following indicator);

- Signal Trend.

Trade only in the dirrection of the trend if the price is above carmen eyes only buy, if the price is below yhe carmen eyes only sell.

If the price is above the Kumo, then there is an uptrend in place and/or more buying opportunities. And if the price is below the Kumo, then it is under resistance and it is better to be looking for shorts instead of longs.

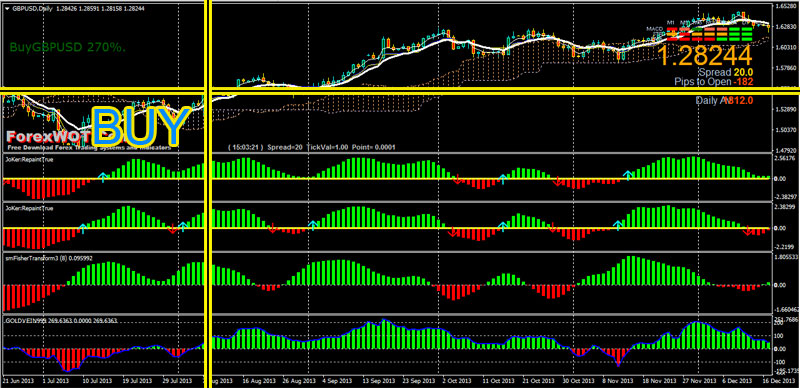

BUY Rules

- The price is above the Kumo, there is an uptrend in place and/or more buying opportunities

- Price above carmen eyes (blue line);

- Fisher joker (21 period) green bar ;

- Fisher joker (13 period) green bar ;

- SM Fisher Transform (8 period) green bar ;

- Gold Vein indicator (50 period ) green bar;

- Signal Trend green bar.

If these conditions are agree buy at opening of the next bar.

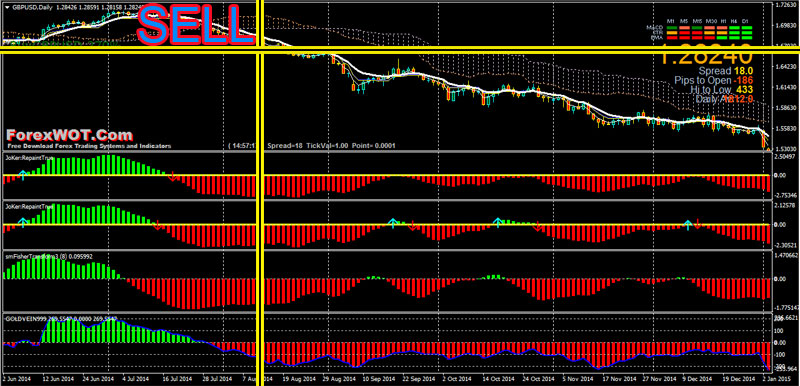

SELL Rules

- The price is below the Kumo, it is under resistance and it is better to be looking for shorts instead of longs.

- Price belo carmen eyes (yellow line);

- Fisher joker (21 period) red bar ;

- Fisher joker (13 period) red bar ;

- SM Fisher Transform (8 period) red bar ;

- Gold Vein indicator (50 period ) red bar;

- Signal Trend red bar.

If these conditions are agree sell at opening of the next bar.

EXIT Rules

- Exit position when joker repaint indicator (21 period change direction) or with ratio 1:2 or 1:3 stop loss.

- Place intial stop loss for buy 5 pips below yellow line, for sell 5 pips above blue line.

Tips: Find the currency pair in trending.

[sociallocker]

[/sociallocker]