DOWNLOAD NOW Top 10 Best EUR-USD Forex Trading Systems and Strategy – The United States and the European Union are the two largest economic powers in the world. The U.S. dollar is both the world’s most heavily traded and most widely held currency.

The currency of the European Union, the euro, is the world’s second most popular currency. And since it contains the two most popular currencies in the world, the EUR/USD pair is forex’s most actively traded currency pair. And below are Top 10 Best EUR-USD Forex Trading Systems and Strategy.

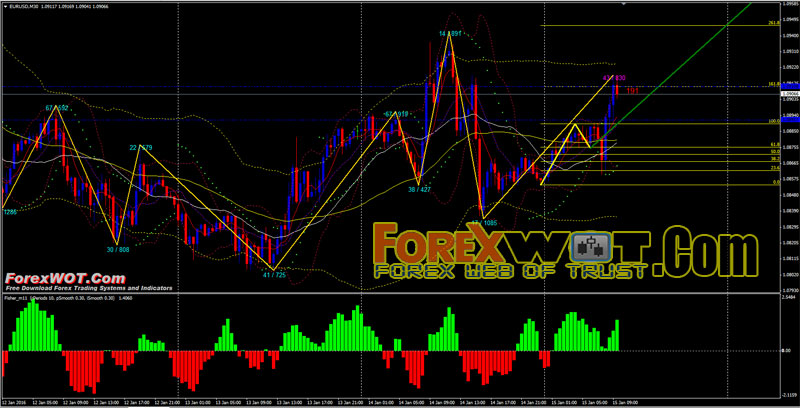

Forex Multi Bands Intraday Trading System with Double MACD and Laguerre Trend Indicator

High Accuracy Forex Multi Bands Intraday Trading System – This system which is called “Forex Multi Bands Intraday Trading System with Double MACD and Laguerre Trend Indicator”, is even simpler because you don’t have to be worried about the candlestick patterns.

You don’t have to know the weak and strong candlestick patterns and differentiate them from each other. You don’t have to know anything about complicated technical analysis.

High Profit Forex Trading System Based on Ichimoku as Filter of ADX Advanced and Pallada Entry signal

Pallada Ichimoku Trading System. This is Advanced High Profit Forex Trading System Based on Ichimoku as Filter of ADX Advanced and Pallada Entry Signal.

The Ichimoku indicator is comprised of five lines called the tenkan-sen, kijun-sen, senkou span A, senkou span B and chickou span.

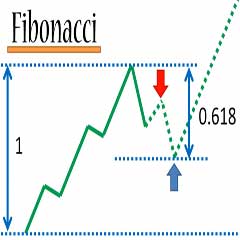

Forex Fibonacci Retracement Price Action Systematic Trend Following Trading Strategy

Price Action Forex Fibonacci Retracement Systematic Trend Following Trading Strategy – This intraday (M30) high accuracy forex trading system works also with higher time frame.

The Fibonacci retracement is the potential retracement of a financial asset’s original move in price. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction.

These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

Fibonacci retracement is a very popular tool used by many technical traders to help identify strategic places for transactions to be placed, target prices or stop losses.

Renko Bar Chart and Momentum Trading System

High Accuracy Renko Bar Chart Trading System. I will tell how to Correctly Identify Forex Trend with Renko Bar Chart Trading System – You might be familiar with renko charts. These are simply boxes that are plotted when price closes an “x” number of pips above or below the previous close.

[sociallocker]

[/sociallocker]

This charting methodology differs from the more traditional candlestick or bar charts. So while you might find renko charts to be different in their appearance, they have a unique capability of showing you the trends as well as help you to easily identify support and resistance levels.

“Momentum” indicator in general refers to prices continuing to trend. The momentum indicator show trend by remaining positive while an uptrend is sustained, or negative while a downtrend is sustained.

A crossing up through zero may be used as a signal to buy, or a crossing down through zero as a signal to sell. How high (or how low when negative) the indicators get shows how strong the trend is.

The conventional interpretation is to use momentum as a trend-following indicator. This means that when the indicator peaks and begins to descend, it can be considered a sell signal. The opposite conditions can be interpreted when the indicator bottoms out and begins to rise.

Super High Accuracy M15 Forex Trading Strategy with Multi Info Indicator

Super High Accuracy M15 Forex Trading Strategy with Multi Info Indicator – Multi Info indicator is a valid Indicator giving you a global overview of how the forex currency is behaving on every timeframe. This high accuracy trading system gives you a lot of market information.

Of the three possible market conditions, TRENDS are probably the most popular amongst traders; and the reason for that is what we had alluded to a little earlier.

The future is opaque, and price movements are unpredictable. By simply recognizing a trend, the trader has noticed a bias that has shown itself in the marketplace.

Maybe there is improving fundamental data for that economy; or perhaps it’s a central-bank driven move on the back of ‘Yen-tervention’ or another round of QE.

How to succeed at Forex Trading with Heiken Ashi Laguerre Trading System and Strategy

High Profits Forex Heiken Ashi Laguerre Trading System and Strategy – Heikin-Ashi chart looks like the candlestick chart, but the method of calculation and plotting of the candles on the Heikin-Ashi chart is different from the candlestick chart.

In candlestick charts, each candlestick shows four different prices: Open, Close, High and Low price. Every single candlestick is independent from others and has no relation with the previous or next candlestick.

How To Trade Forex with Donchian Channel Trend RSI Trading System

Forex with Donchian Channel Trend RSI Scalping Trading System – The Donchian Trend RSI Trading system is fairly simple to apply, but is incredibly powerful.

Using a Donchain Channel system is not a new idea. Donchian channels are used to show volatility, breakouts and potential overbought/oversold conditions for a security.

The Donchian system uses adjustable bands that are set equal to the n-period’s highest highs and lowest lows across a moving average.

The upper and lower bounds of a Donchian channel can also form effective support and resistance levels, particularly when used in combination with other technical indicators.

Forex Pivot Point Support Resistance Trading System with Market Volume and MACD Indicator

How to make forex trading decisions based on volume – High Accuracy and Easy Forex Pivot Point Support Resistance Trading System with Market Volume and MACD Indicator.

Volume is required to move a market, but it’s a particular type of volume that really matters: institutional money, or “smart money,” which is large amounts of money being traded in a similar way, thus affecting the market greatly.

Only volume shows when price is being affected by this type of activity. Knowing how institutional money operates, we are able to track those traders and trade along with them, so that we’re swimming along with the proverbial sharks rather than being their next meal.

High Profits Forex Intraday Trend Following Trading System and Strategy

Forex Intraday Trend Following Trading System – The key to this simple trading system and strategy is the search direction of the day as a filter.

[sociallocker]

[/sociallocker]

Best Time Frame : H1,

Markets : Forex, Commodities.

- White line is the priceline.

- Gold line is the brekline.

- Dodgerblue/Deep Pink is the Cycle line.

- Blue Crimson is the trend line.

- Golden Gunsight is the hig channel determinant.

Trade Signal is given the Price line crossing the Cycle line and confirmed by the candles turning blue or red.

Watch the color of the trafficlight ring as it shows which direction the pricelline is in relation to daily open. As a rule of thumb you do not want to be trading against the ring color.

- White price line aboove the green daily open line = Direction Up ( Aqua ring).

- White price line below the green daily open line = Direction down ( magenta Aqua ring).

Most Accurate Moving Average TrendLine Trading System

Forex Trading System with a smart and reliable indicator of the trend lines True Trendline. MA TrendLine is highly accurate trend following forex strategy. The system gives you clear signals which will definitely help you to make best trades. Forex MA TrendLine hasn’t used any indicators that are hard to understand and that is confusing either. The chart looks very clean and professional.

[sociallocker]

[/sociallocker]

There are six technical indicators that contribute to generating signals. Forex MA TrendLine can be used to trade in any time frame with any currency pairs but make sure that you are trading in a trending market not flat.

NOTE : Factors Influencing the Direction of the EUR/USD

The primary issue that influences the direction of the euro/U.S. dollar pair is the relative strength of the two economies. Holding all else equal, a faster-growing U.S. economy strengthens the dollar against the euro, and a faster-growing European Union economy strengthens the euro against the dollar. As previously discussed, one key sign of the relative strength of the two economies is the level of interest rates.

When U.S.interest rates are higher than those of key European economies, the dollar generally strengthens. When Eurozone interest rates are higher, the dollar usually weakens. However, as we’ve already learned, interest rates alone can not predict movements in currencies.

Another major factor that has a strong influence on the euro/U.S. dollar relationship is any political instability among the members of the European Union. The euro, introduced in 1999, is also relatively new compared to the world’s other major currencies. Many economists view the Eurozone as a test subject in economic and monetary policy. As the countries within the Eurozone learn to work with one another, differences sometimes arise. If these differences appear serious or potentially threatening to the future stability of the Eurozone, the dollar will almost certainly strengthen against the euro.

The list below shows the current members of the Eurozone as of January 1, 2009. When trading the euro/U.S. dollar pair, investors should carefully watch for troublesome economic and political news originating in these countries. If several Eurozone countries have weakening economies, or if newspaper headlines are discussing political difficulties among the countries in the region, the euro is likely to weaken against the dollar.

Members of the Eurozone

- Austria

- Belgium

- Cyprus

- Finland

- France

- Germany

- Greece

- Ireland

- Italy

- Luxembourg

- Malta

- Netherlands

- Portugal

- Slovakia

- Slovenia

- Spain

Due to the fact that the euro and U.S. dollar are the world’s two largest currencies, representing the world’s two largest economic and trading blocs, many multinational corporations conduct business in both the United States and Europe. These corporations have an almost constant need to hedge their exchange rate risk. Some firms, such as international financial institutions, have offices in both the United States and Europe. Firms that fit this description are also constantly involved in trading the euro and the U.S. dollar.