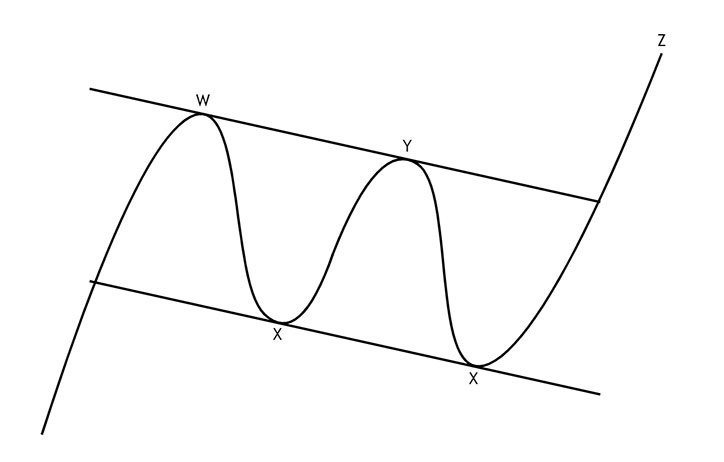

BITCOIN – Final Steps Before CLEAR Up-Trend…! The majority of analysts think that the price has broken through the resistance of the channel/wedge and now testing this level.

Nothing threatens $BTC.

However, if we draw the resistance of this channel by highest points, we can mention that the price was at resistance level not long ago and now located inside the channel, again. It jeopardizes growth.

On the other hand, we have a support level inside the channel, the same that most of the other traders consider as a resistance of the downward channel.

There is also EMA200 around $8200 that also plays as support.

If the price smashes $8700 and $9000, there’s a big chance to see $9400, $10000 and even higher levels.

However, if the $8200 level appears weak and BTC price falls below it, the vector could be quite nasty and lead us to $7600 – $7700 levels.

Anyway, the priority is clearly upward, above $8200 Bitcoin looks really bullish.

At the same moment, BTC dominance is ready to get out of the downward channel, which usually means future growth.

High profitability trading with Forex MA Parabolic Bollinger Bands Trading System – This is a Trend Following trading system. The TMA Slope indicator MT4 is the filter for an entry position.

- Best Risk-Reward Raio is 1:3

- Put your initial stop loss above or below the “Gann For PS” line

- Do not become emotionally involved in your trade. It does not matter whether you are wrong or right.

[sociallocker]

[/sociallocker]