High Accuracy Forex Step Stochastic Intraday Trading with Snake Custom Indicator – Intraday traders are mostly full time traders and it is imperative that they dedicate themselves to the task during whatever market hours they trade.

Strictly, intraday trading is trading only within a day, such that all positions are closed before the market closes for the trading day. Many traders may not be so strict or may have day trading as one component of an overall strategy. Traders who participate in intraday trading are called day traders. Traders who trade in this capacity with the motive of profit are therefore speculators.

Some of the more commonly day-traded financial instruments are stocks, options, currencies, and a host of futures contracts such as equity index futures, interest rate futures, and commodity futures. And this is High Accuracy Forex Step Stochastic Intraday Trading Strategy.

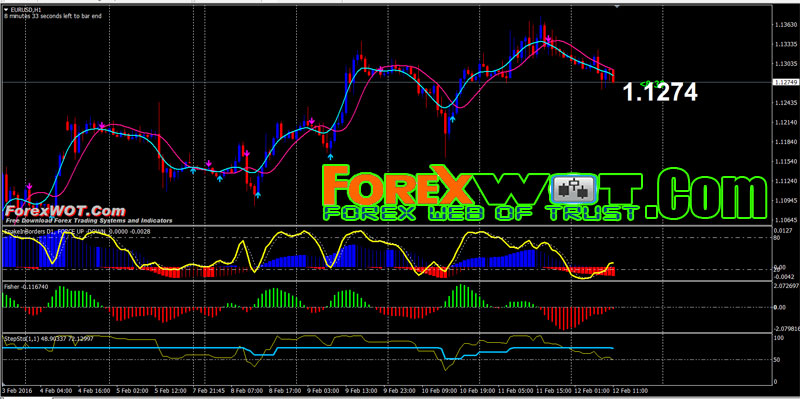

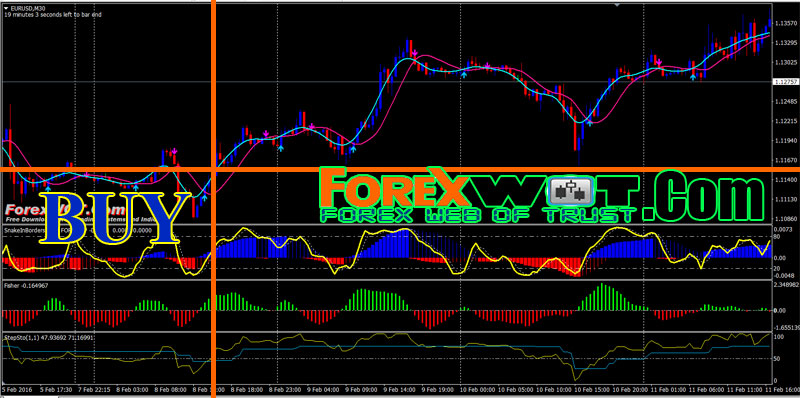

This Trading System can be use for all Major Currency Pairs. But best use in the time frame 30 min for intraday trading. It ‘s a best trading method that i have used all this time.

MetatraderIndicators:

- Step Stoch;

- Stochastic Oscillator;

- XPS V.8 Price;

- Fisher indicator;

- Snake indicator;

- Snake Force indicator;

- T3 Clean indicator;

- Unicross.

- Blue up Arrow,

- Snake indicator Blue upward and above red T3 Moving Average (14) line,

- Snake in border indicator blue and above 0 line with Stochastic oscillator upward,

- Fisher blue,

- Yellow Step Stochastic line upward and above blue line.

- Magenta down Arrow,

- Snake indicator Blue upward and below red T3 Moving Average (14) line,

- Snake in border indicator red and below 0 line with Stochastic oscillator downward,

- Fisher red,

- Yellow Step Stochastic line downward and below blue line.

Rules employed by intra-day traders

Many intra-day traders follow certain guidelines to limit losses. They:

- Invest what they can afford to lose – Intra-day trading carries more risk than investing in stocks and an unexpected movement can wipe out their entire investment in a few minutes.

- Choose highly liquid shares – Intra-day traders must square their positions at the end of the trading session.

- Trade only in two or three scrips at a time – There is a need to closely monitor the stock or currency movements.

- Research watch list thoroughly.

- Fix entry price and target levels – The psychology of the buyer changes after they have bought a stock or currency, which could interfere with their judgment and nudge them into selling too quickly even if the price moves up marginally.

- Use stop losses to contain impact – This helps the trader limit losses in case the share belies expectations and moves down (or up).

- Are not investors – Shares are bought with an ultra short-term horizon.

- Book profits when targets are met – Greed and fear are the two biggest hurdles for the intra-day trader.

- Don’t fight the market trend – Even the most sophisticated analysis cannot predict which way the market will move.

- Remember small is beautiful – While stock investments can yield stupendous returns, be content with small gains from intra-day trading.

Because intra-day traders close out their positions in the stocks or currency they own at the end of the day, whether winning or losing, some of the risks are limited. There is no hangover. Each day is a new day, and nothing can happen overnight to disturb an existing profit position.