BEST London sesion trading system ForexWOT Multi Trend Market Signals. Trading the London Session (about 30% of all forex transactions happen during the London session) with a Very Easy and Profitable Strategy.

Historically, London has always been at a center of trade, thanks to its strategic location. It’s no wonder that it is considered the forex capital of the world with thousands of businessmen making transactions every single minute.

Some key characteristics of the London and European session

- Because the London session crosses with the two other major trading sessions and the city itself is a massive financial center a huge amount of Forex transactions are taking place during the European session. This leads to high liquidity and lower pip spreads.

- The London trading session is normally the most volatile session due to the large amount of transactions that take place.

- Volatility, however, tends to reduce in the middle of the session as traders often go off to have lunch before waiting the New York session to begin.

- Most trends begin during the London session, and they typically will continue until the beginning of the New York session.

- These trends can sometimes reverse at the end of the London session, as European traders may decide to lock in profits.

ForexWOT Multi Trend Market Signals Trading Rules

Which Pairs Should You Trade? Because of the volume of transactions that take place, there is so much liquidity during the European session that almost any pair can be traded.

Of course, it may be best to stick with the majors (EUR/USD, GBP/USD, and USD/JPY), as these normally have the tightest spreads.

Also, it is these pairs that are normally directly influenced by any news reports that come out during the European session.

- Best Time Frame : 30M and 1H (London, Europe, and New York Session)

Forex MetaTrader Indicator

- FX Market Signals

- Multi Trend Signal

- Momentum

- Ichimoku Cloud

- Pivots (Bain) – Optional Indicator

Trade only when the candles outside ichimoku cloud (above the cloud to BUY opportunity and below the cloud to SELL opportunity)

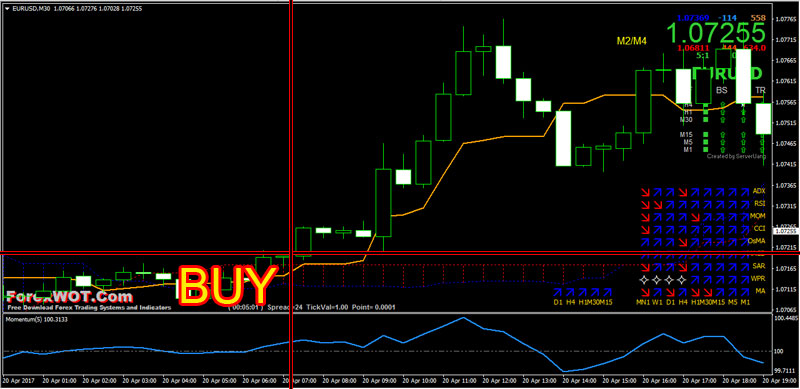

BUY Rules

- FX Market Signals green color

- Multi Trend Signal blue color

- Momentum line upward above 100 level

- Price upward above Ichimoku Cloud

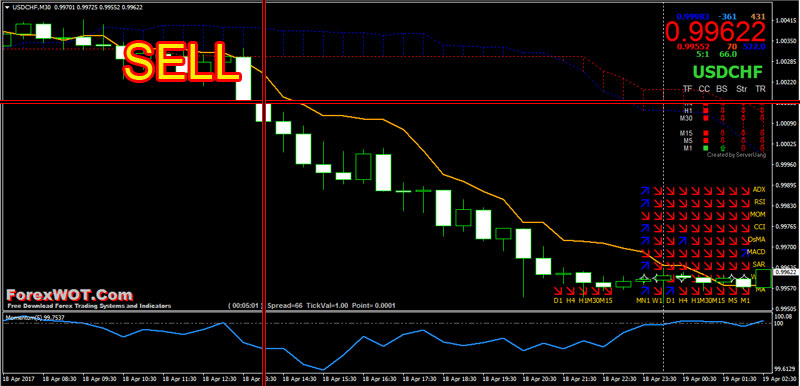

SELL Rules

- FX Market Signals red color

- Multi Trend Signal red color

- Momentum line downward below 100 level

- Price downward below Ichimoku Cloud

The best and worst times to trade Forex for a beginner

- Best times to trade for a beginner:

When two sessions are overlapping.

This means that most liquidity and lowest spreads are available as well as these are also the times where major news events come out to potentially spark some volatility and directional movements.

The European session tends to be the busiest one out of the three.

The middle of the week typically shows the most movement, as the pip range widens for most of the major currency pairs.

- Worst times to trade for a beginner:

Sundays – The lowest amount of liquidity available.

Fridays after 5 PM GMT – Again lower amount of liquidity, because people are getting ready for the weekend.

Holidays or major events – Everybody is either taking a break or following the big event.