Awesome Oscillator is one of the most famous indicators developed by Bill Williams. This indicator is a basic calculation of the two simple moving averages, and it gauges the current driving forces of the market. This is done by comparing the recent market momentum, with the general momentum over a wider time frame.

The Awesome Oscillator is useful for technical analysis because it takes more standard momentum oscillators and adjusts the calculation in order to strengthen a common weakness among them. However, it really becomes one of most effective trading indicators when confirming signals or conditions is identified by additional technical analysis.

The Awesome Oscillator is available on most trading platforms, such as Tradingview and MetaTrader. The indicator is also available on many free online charting sites, such as Investing.com, StockCharts.com and Yahoo! Finance.

And now, let’s briefly cover the 3 most popular awesome oscillator strategies for day trading.

- Download “ForexWOT-AwesomeOscillatorSystem” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-AwesomeOscillatorSystem.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-AwesomeOscillatorSystem” trading system and strategy.

- You will see the “Awesome Oscillator System” is available on your Chart.

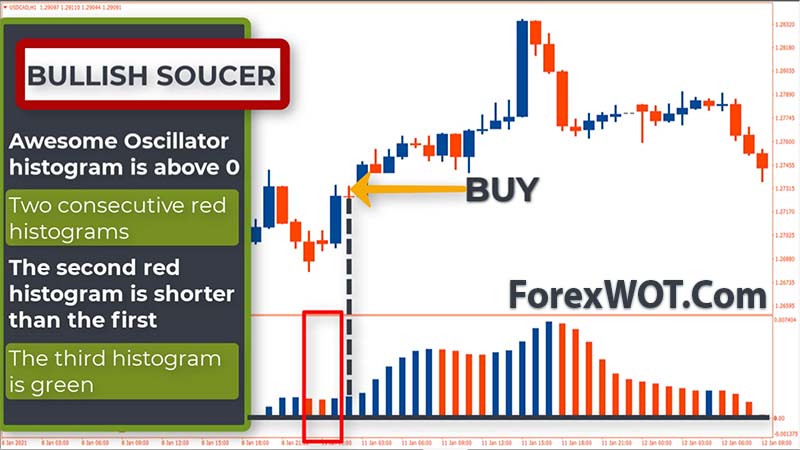

The Awesome Oscillator saucer signal helps you identify pure momentum continuation trades. In other words, if you miss the boat on a trend signal the Awesome Oscillator saucer will give you a second chance to enter a trend or to simply build up your trading position.

So, how do we deal with missing trading opportunities?

- The Awesome Oscillator histogram is above the zero line.

- We have 2 consecutive red bars.

- The second red histogram is shorter than the first.

- The third bar is green and higher than the second bar.

- Stop Loss

You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. Your stop loss is below the swing low.

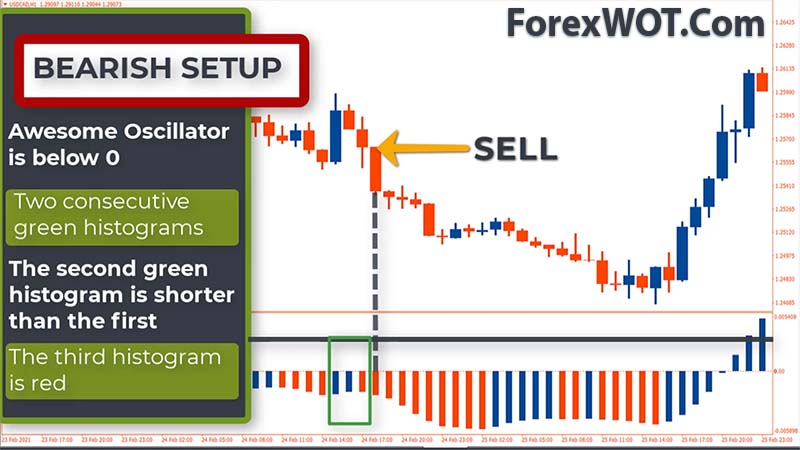

- The AO histogram is below the zero line.

- We have 2 consecutive green bars.

- The second green bar is lower than the first bar.

- The third bar is red and lower than the second bar

- Stop Loss

You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. Your stop loss is above the swing high.

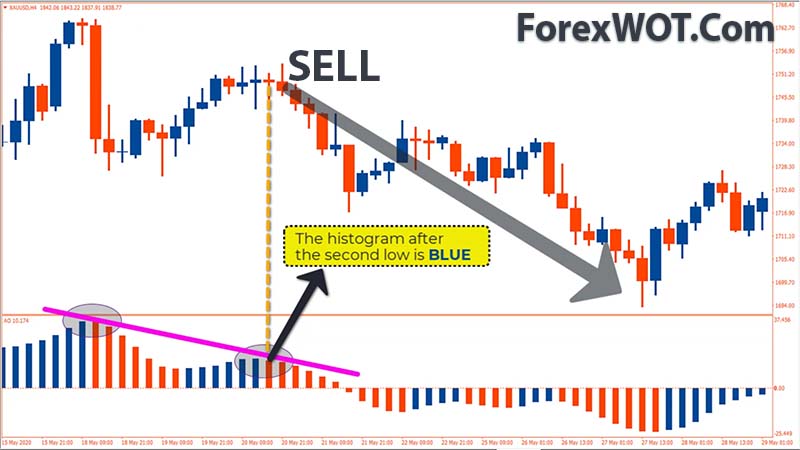

This is a basic strategy, which looks for a double bottom in the awesome oscillator indicator. Twin Peaks is a method which considers the differences between two peaks on the same side of the Zero Line.

- A Bullish Twin Peaks setup occurs when there are two peaks below the Zero Line.

The second peak is higher than the first peak and followed by a green bar. Also very importantly, the trough between the two peaks, must remain below the Zero Line the entire time. - Stop Loss

You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. Your stop loss is below the swing low.

- A Bearish Twin Peaks setup occurs when there are two beaks above the Zero Line.

The second peak is lower than the first peak and followed by a red bar. The trough between both peaks, must remain above the Zero Line for the duration of the setup. - Stop Loss

You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. Your stop loss is above the swing high.

This approach would keep us out of choppy markets and allow us to reap the gains that come before waiting on confirmation from a break of the 0 line.

- Awesome Oscillator has two swing highs above the 0 line

- Draw a trend line connecting the two swing highs down through the 0 line

- Buy a break of the trend line

- Stop Loss

You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. Your stop loss is below the swing low.

- Awesome Oscillator has two swing lows below the 0 line.

- Draw a trend line connecting the two swing lows up through the 0 line.

- Sell Short a break of the trend line.

- Stop Loss

You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. Your stop loss is above the swing high.

The Bill Williams Awesome oscillator strategy is a great strategy if you’re a momentum trader. how ever, No matter which strategy you use, don’t forget to place your Stop Loss and protect your profits. We recommend you to pair this indicator with Price Action pattern, or any other indicators to generate more accurate trading signals.