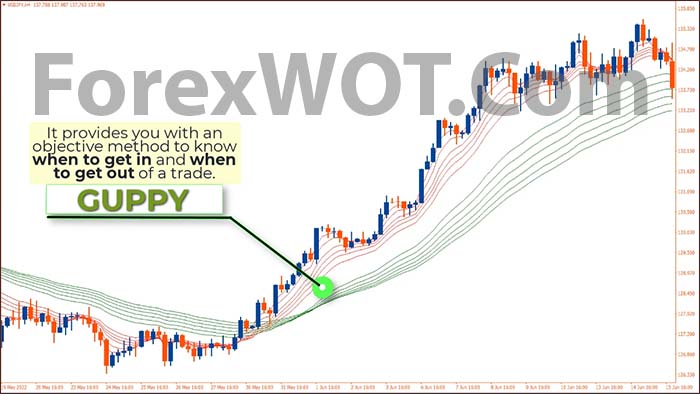

The Guppy Multiple Moving Average (GMMA) is a tool used in trading to spot shifts in trends, breakouts, and potential trading chances in an asset’s price. It does this by combining two sets of moving averages (MA) with varying time periods.

The Guppy Multiple Moving Average (GMMA) was developed by an Australian trader named Daryl Guppy, which is why it bears his name. Daryl introduced the GMMA in his book, Trend Trading.

The Guppy technique is a trend-tracking method that consists of 12 exponential moving averages (EMAs). By using multiple lines, the Guppy enables traders to perceive the strength or weakness of a trend more effectively compared to relying on just one or two EMAs.

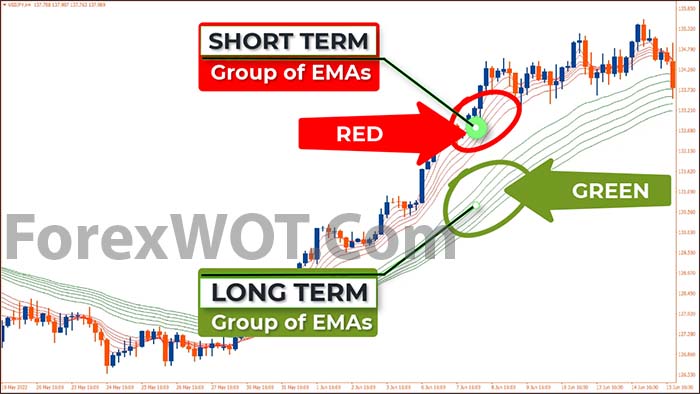

The 12 EMAs are divided into two groups:

- The first group comprises six EMAs with shorter time periods, often referred to as the “short-term” group.

- The second group consists of six EMAs with longer time periods, known as the “long-term” group.

The crossover of the short- and long-term moving averages represents trend reversals.

If the short-term EMAs cross ABOVE the long-term moving averages, this is known as a bullish crossover and indicates that a bullish reversal has occurred.

If the short-term EMAs cross BELOW the longer-term ones, this is known as a bearish crossover and indicates that a bearish reversal is occurring.

- Download “ForexWOT-GuppyMMA” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-GuppyMMA.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-GuppyMMA” trading system and strategy.

- You will see the “ForexWOT-GuppyMMA System” is available on your Chart.

The following are the conditions to be met for making a BUY:

- When all short-term EMA cross above all the long-term EMAs, a new bullish trend is confirmed and triggers a buy signal.

- During a strong uptrend, when the short-term MAs move back toward the longer-term MAs, but do NOT cross, and then start to move back higher, this signals another continuation of the bullish trend and triggers a buy signal.

Stop LOSS:

As soon as your entry order has been filled, make sure that your trading software has placed your target and stop-loss orders, or place them manually if necessary.

The following are the conditions to be met for making a BUY:

- When all short-term EMAs cross below all the long-term EMA, this indicates a new bearish trend and triggers a sell signal.

- During a strong downtrend, when the short-term MAs move back toward the longer-term MAs, but do NOT cross, and then start to move lower, this signals a continuation of the bearish trend and triggers a sell signal

Stop LOSS:

As soon as your entry order has been filled, make sure that your trading software has placed your target and stop-loss orders, or place them manually if necessary.

The Guppy Multiple Moving Average (GMMA) is a system designed to follow trends in trading. When you trade in alignment with the trend, your chances of winning are generally higher than losing.

The Guppy system enables you to visualize two possible scenarios: a trend reversal or a trend continuation. While it is a straightforward indicator, the Guppy system performs optimally when the price is clearly exhibiting a trend.