Setting REALISTIC Profit Target and Stop Loss is an important part of good money management, and setting the maximum amount you are willing to lose per day, week, and a month is equally as important.

Another aspect of good money management is risking a small percentage (.5 – 1% or less) of your total account balance per trade.

Depending on your trading style, you should also only take trades with the potential of making TWICE what you are risking or more.

That ratio is known as the RISK-REWARD RATIO.

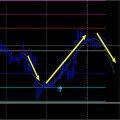

ForexWOT Target Indicator

In this article, I’ll show you how to set and calculate Take Profit and Stop Loss easily.

To new traders, this indicator may seem foreign, but they are absolutely essential to long-term profitability.

- Best Time-frame: H1 (intraday trading)

- Most Recommended Currency Pairs: GBPUSD and EURUSD

How to Set Take Profit & Stop Loss

Remember…!

- You always should think about RISK before REWARD and you should be at least two times more focused on risk per trade than you are on the reward.

- We need to determine our stop loss to then determine our position size on the trade, potential dollar loss, and gain.

Trading Rules

- Always use the horizontal lines to determine “Open Position”, “Take-Profit”, and “Stop-Loss”.

- You should also only take trades with the potential of making twice what you are risking or more.