FREE DOWNLOAD 5+ Best Forex London Session Trading Systems and Strategy – The open of the London session at 3:00 AM is when many consider this type of behavior to be starting for the day in the FX Market. By many accounts, London is the heart of the FX market with approximately 35% of daily volume transacted during this session.

As the US session begins 5 hours later, the environment can change quite a bit as even more liquidity is entering the market; and this time it is coming from both sides of the Atlantic.

For the purposes of this article, we are going to focus on the London session, before the US opens for business (3-8 AM Eastern Time). And below are 5+ Best Forex London Session Trading Systems & Strategy…

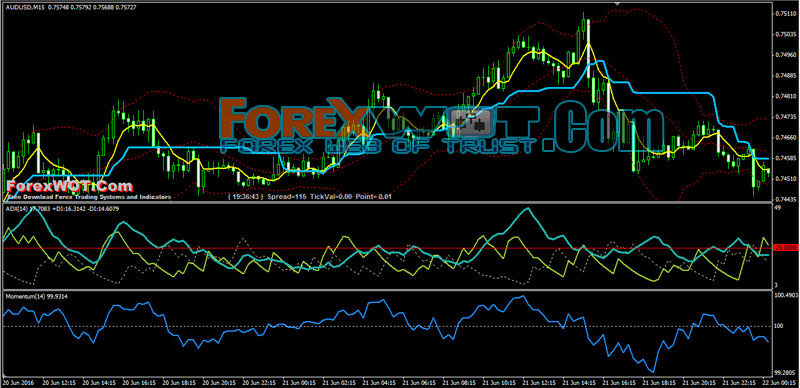

Forex Bollinger Bands Momentum ADX Technical Analysis Trading

DOWNLOAD High Profits Forex Technical Analysis -Forex Bollinger Bands Momentum ADX Technical Analysis Trading. Technical analysis is a trading tool employed to evaluate securities and attempt to forecast their future movement by analyzing statistics gathered from trading activity, such as price movement and volume.

Unlike fundamental analysts who attempt to evaluate a security’s intrinsic value, technical analysts focus on charts of price movement and various analytical tools to evaluate a security’s strength or weakness and forecast future price changes.

RSIOMA Trend Magic Trading System and Strategy

How to Immediately Become A Successful Trader – Becoming a successful trader is not as difficult or elusive as you probably think right now. I recommend reading this entire article through to the end because I believe the information I’m about to share might just be the ‘missing piece’ of the trading puzzle you have been trying to put together… With RSIOMA Trend Magic Trading System and Strategy you will be Immediately Become A Successful Trader.

[sociallocker]

[/sociallocker]

RSIOMA Trend Magic Trading System and Strategy is intraday trading system with clear accurate trade signals. Be aware, most of the time you should be waiting patiently for high-probability trades to set up, in other words, you should trade like a sniper.

RSIOMA indicator takes two moving averages, calculates their RSI (Relative Strength Index) and then also adds a moving average of the calculated RSI. These two lines now can accurately signal the trend changes. They are shown in the separate window where they change from 0 to 100. Additional histogram indicator is shown for quick reference below the lines.

Forex Parabolic MultiTimeFrame Trading System With TMA Slope Custom Indicator

Get 95% Accuracy and High Profitability with Forex Parabolic MultiTimeFrame Trading System – This is a Trend Following trading system. Tha Parabolic SaR 4 time frames indicator MT4 is the filter for entry position.

[sociallocker]

[/sociallocker]

Forex Parabolic MultiTimeFrame Trading System is High Accuracy and Profitability trading system. But be disciplined – This means that you have to know when to buy and sell. Base your decisions on your pre-planned strategy and stick to it.

Sometimes you will cut out of a position only to find that it turns around and would have been profitable had you held on to it. But this is the basis of a very bad habit. Don’t ignore your stop losses – you can always get back into a position. You will find it more reassuring to cut out and accept a small loss than to start wishing that your large loss will be recouped when the market rebounds. This would more resemble trading your ego than trading the market.

Forex M15 Price Action Retracement Trading System with Non Repaint EATA Pollan indicator

Easy simple Forex Price Action Retracement Trading System with Non Repaint EATA Pollan and Exponential Moving Average Indicator.

Time Frame : 15 min or higher.

Currency pairs : any.

Trading Forex Trends With Moving Averages and Trigger Indicator

High accuracy Trading Forex Trends With Moving Averages and Trigger Indicator – It can be extremely difficult for new traders to finalize a trend trading strategy for trading the Forex market. However, the good news is that most trend based strategies can be broken down into three different components. Today we are going to review the basics of a trending market strategy by identifying the trend, planning an entry, and identifying an exit.

The first step to trend trading is to find the trend! There are many ways to identify the EURUSD trend pictured below, but one of easiest is through 10 MA high and low. If price is stair stepping upwards that means price closed above 10 MA high, and the trend is up. Conversely if price is stepping down below 10MA low this mean price is potentially declining in a downtrend.

London is still number one for forex trading

THE CITY has extended its dominance as the world’s No1 location for trading in foreign exchange markets, according to a comprehensive data set published yesterday by the Bank for International Settlements (BIS).

Nearly 41 per cent of global forex trading goes through the intermediation of dealers in the UK – by far the highest market share out of all trading hubs in the world. The US is in second place on 18.9 per cent, with Japan and Singapore effectively tied in third on 5.6 per cent and 5.7 per cent respectively.

And London’s dominance has grown in recent years, as the size of the forex market has expanded.

In 2001 the UK had 31.8 per cent of the global share; this rose to 34.6 per cent by 2007, and 36.8 per cent by 2010.

The survey also showed that worldwide trading has shot up by more than a third since the last report three years ago.

“Trading in foreign exchange markets averaged $5.3 trillion (£3.4 trillion) per day in April 2013 – up from $4 trillion in April 2010 and $3.3 trillion in April 2007,” the BIS research said.

The yen has become increasingly traded in recent times, its share of the market moving from 19 per cent in 2010 to 23 per cent this year. The euro and sterling now occupy less of the market than in 2010.