Swing Trading Forex Trend Turtle Channel System – The turtle channel was originally designed by Richard Donchian as a technical indicator to be used for breakout trading. The channel is created by plotting both the 20-period high price and the 20-period low price, along with an average of the two prices that serves as a centerline within the channel.

The original strategy that Donchian used with the channel is to buy or sell breakouts above or below the channel. However, the turtle channel is also used by traders as a simple trend-following indicator because it typically does a very good job of encompassing both high and low price swings within a long-term trend.

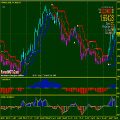

In forex trading, once a trader identifies an overall uptrend by using moving average indicators or an upsloping angle of the channel itself, confirmed by average directional index (ADX) readings above 23 indicating the existence of a genuine trend, the trader looks for a trade entry point near the lower band of the channel, placing a stop 10 to 15 pips below that lower band. The trade position is held until there is a downside breakout of the channel or until price reaches a targeted profit level.

Traders also commonly use the turtle channel for swing trading. A simple forex swing trading strategy is put into play by buying when price approaches the lower channel band and selling when price nears the upper band of the channel. Profit targets are set at either the centerline or the opposite band of the channel. This swing trading strategy can be used in either an overall uptrend or downtrend.

- Price above blue turtle channel

- price above blue double trend lines

- MA color blue

- Candles color ble

- MACD uptrend

- Average Directional Index (ADX) readings above 23 line

- Price below red turtle channel

- price below red double trend lines

- MA color red

- Candles color red

- MACD downtrend

- ADX

- Average Directional Index (ADX) readings above 23 line

Once you have funded your account, the most important thing to remember is that your money is at risk. Therefore, your money should not be needed for living or to pay bills etc.

Consider your trading money as if it were vacation money. Once the vacation is over your money is spent.

Have the same attitude toward trading. This will psychologically prepare you to accept small losses, which is key to managing your risk. By focusing on your trades and accepting small losses rather than constantly counting your equity, you will be much more successful.

Secondly, only leverage your trades to a maximum risk of 2% of your total funds. In other words, if you have $10,000 in your trading account, never let any trade lose more than 2% of the account value, or $200. If your stops are farther away than 2% of your account, trade shorter time frames or decrease the leverage.